Why Does Emerging Market Debt Still Look Attractive?

Emerging market debt (EMB) offers plenty of opportunities to investors. Markets are expected to continue their outperformance for the next few quarters.

Aug. 17 2016, Updated 9:06 a.m. ET

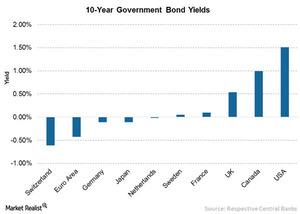

Yet the segment still looks attractive given persistently low developed market bond yields. We believe this relative yield advantage will be a main driver of EM debt returns in the second half. We see hard-currency EM debt providing a more stable income stream than local currency options. EM local debt may offer more upside, however, for those willing to accept currency risk.

Market Realist – Emerging market debt set to outperform this year

Emerging market debt (EMB) offers plenty of opportunities to investors. Markets are expected to continue their outperformance for the next few quarters despite many challenges discussed in the previous section. Recovering oil prices, improving economic fundamentals, and a relatively weak dollar are some of the factors that will likely support emerging markets’ debt (PCY).

Negative-yielding debt

Also, the sharp rise in very low or negative-yielding debt in developed markets attracted investors to emerging market debt (EMLC) (VWOB). According to Tradeweb, ~$13.4 trillion worth of global bonds are currently trading at negative yields—a rise of ~29% since May.

Although the majority of negative-yielding debts are Japanese and European sovereign bonds, many corporate bonds are also trading at a sub-zero yield. Japan launched aggressive stimulus measures—it has the largest amount with negative yields at ~$8 trillion. Last month, the yield on the 20-year Japanese bond fell below zero for the first time.

In the Eurozone, Germany, France, and Italy have more than $1.5 trillion in negative-yielding debt. German ten-year bunds are trading at -0.08%, while all of Switzerland’s government bonds turned negative in June. Even the yield on the long-term Swiss bond due in 2064 fell below zero for the first time. In the United Kingdom, yields on bonds due in 2019 and 2020 fell to -0.017% and -0.015%, respectively, after the Bank of England announced monetary measures to stimulate the economy. Similarly, the ten-year Australian yield fell to a record low of 1.9%.

Investors generally favor hard currency emerging markets bonds, although local currency bonds (LEMB) are also in demand lately.