What Do Overvalued Water Utilities Indicate?

Given the sharp rally during the past six months, major water utilities are trading at huge premiums compared to their historical valuation multiples.

Nov. 20 2020, Updated 12:10 p.m. ET

Valuations

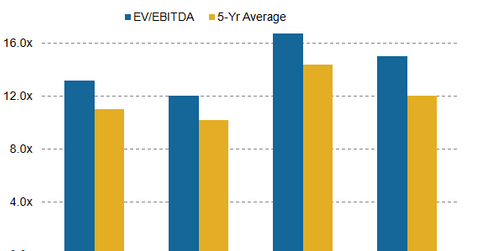

Given the sharp rally of US water utilities during the past six months, major water utility companies are trading at huge premiums compared to their historical valuation multiples. As of August 16, 2016, American Water Works (AWK) is trading at an EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) multiple of 13.2x, while its five-year historical average multiple is 11x. However, a recent fall of about 10%–15% has created room for new buyers.

Remember, EV-to-EBITDA measures whether a stock is overvalued or undervalued, regardless of the company’s capital structure.

By comparison, American States Water (AWR) and Aqua America (WTR) are trading at an EV-to-EBITDA valuations of 12x and 16x. California Water Service’s multiple is 15x, while the historical average for US water utilities stands at roughly 11x–12x.

PE ratio

Water utilities (PHO), historically, have traded at price-to-earnings ratios of 16x–18x. But American Water Works is currently trading at a PE (price-to-earnings) ratio of 28x, while American States Water is trading at a PE ratio of 26x, and California Water Service is trading at a PE multiple of 35x.

Electric utilities are also trading at high premiums. But the recent correction in water utilities could be more severe, and investors may choose to remain invested in electrics longer. Notably, yields offered by US electric utilities are usually more than double that of water utilities. We should also note that the US electric utilities segment (XLU) tends to offer a more diversified and investor-specific range.

In the next part, we’ll discuss declining water usage.