AGCO Acquires Cimbria, Expands in Seed and Grain Handling

On June 29, AGCO (AGCO) announced that it acquired Cimbria Holdings from Silverfleet Capital for 310 million euros ($340 million).

Aug. 11 2016, Updated 9:05 a.m. ET

AGCO acquires Cimbria

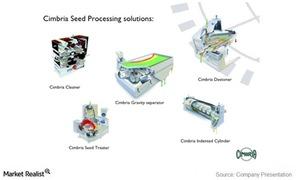

On June 29, AGCO (AGCO) announced that it acquired Cimbria Holdings from Silverfleet Capital for 310 million euros ($340 million). Silverfleet is a private equity firm. It acquired Cimbria for 137 million euros in 2013. The transaction is expected to be closed by 3Q16 after regulatory approval. Cimbria is based in Denmark. It manufactures equipment used in the handling, processing, and storage of seeds and grain. Cimbria’s revenues in fiscal 2016 are expected to be ~$240 million with a major portion of its exposure concentrated in Western Europe. However, after acquiring Cimbria, Silverfleet expanded its sales operations in the high-growth Middle Eastern region which imports seeds and grains. Cimbria will be integrated into AGCO’s grain and seed handling equipment business.

Management’s commentary

On the latest acquisition, Martin Richenhagen, AGCO’s chairman, president, and CEO, offered the following commentary. He said that “The acquisition of Cimbria significantly enhances our market position in the European grain handling and storage industry.” He added that “Cimbria’s products are complementary to our GSI’s offerings and are recognized by its customers for their design, quality, and innovation. This combination also provides significant marketing and cost-saving synergies and will provide us with a global leadership position in the seed handling industry as well as further strengthen our capabilities to serve large global customers. With margins similar to GSI, the acquisition of Cimbria provides us an attractive opportunity to grow our business and expand our margins.”

Key ETFs

Investors interested in trading in agribusinesses could look into the PowerShares DB Agriculture Fund ETF (DBA). Those interested in trading in dividend-based ETFs might look into the Vanguard Dividend Appreciation ETF (VIG). Major holdings in VIG include Microsoft (MSFT), with a holding of 3.7%, and Coca-Cola Company (KO), with a holding of 3.9%