A Look at Boston Scientific’s Valuation Multiples in September

On September 14, Boston Scientific (BSX) was trading at a forward price-to-earnings ratio of 24.4x, compared to the industry’s average PE ratio of 22.4x.

Nov. 20 2020, Updated 5:25 p.m. ET

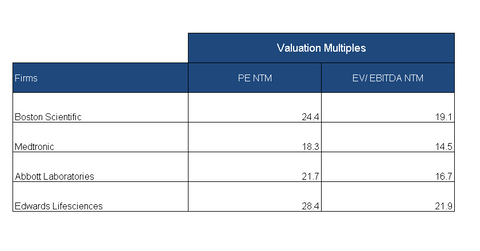

Boston Scientific’s forward valuation multiples

On September 14, Boston Scientific (BSX) was trading at a forward PE (price-to-earnings) ratio of 24.4x, compared to the industry’s average PE ratio of 22.4x. Another key valuation multiple that is a capital structure–neutral valuation metric is EV-to-EBITDA.[1. enterprise value to earnings before interest, tax, depreciation, and amortization] Boston Scientific’s forward EV-to-EBITDA multiple is 19.1x, which is higher than the industry average of 16.7x. So, Boston Scientific seems to be trading at higher valuations than the industry average.

Peer valuation multiples

On September 14, Boston Scientific’s peers Abbott Laboratories (ABT), Edwards Lifesciences (EW), and Medtronic (MDT) had forward PE multiples of 21.7x, 28.4x, and 18.3x, respectively. These companies have EV-to-EBITDA multiples of 16.7x, 21.9x, and 14.5x, respectively.

The division of the current stock price of the company by the NTM (next-12-months) earnings estimates yields the forward PE ratio. This ratio is representative of the stock market’s perception of the stock’s growth potential for the next year. A high forward PE generally implies that the stock is overvalued or that the company is a high-growth business.

Triggered by a number of key launches and acquisitions, Boston Scientific has seen its valuation increase. BSX stock has risen ~4.5% over the last week and ~12% over the last month.

Be sure to check out all the data we’ve added to our quote pages. Now you can get a valuation snapshot, earnings and revenue estimates, and historical data, as well as dividend information. Take a look!