Cliffs Natural Resources: What Will Drive Performance after 2Q17?

The 2Q17 earnings season for US-based steel companies is now over. Cliffs Natural Resources (CLF) released its 2Q17 results on July 27, 2017, before the market opened.

Aug. 3 2017, Published 1:32 p.m. ET

Earnings season comes to an end

The 2Q17 earnings season for US-based steel companies is now over. Cliffs Natural Resources (CLF) released its 2Q17 results on July 27, 2017, before the market opened.

U.S. Steel (X) and AK Steel (AKS) reported their results on July 25, 2017, after the markets closed. ArcelorMittal (MT), the world’s largest steelmaker, released its 2Q17 earnings on July 27, 2017.

Mixed earnings

The results season for the US steel sector (SLX) was mixed, with some companies beating the estimates and others missing them. Cliffs Natural Resources’ 2Q17 results were a beat on the market’s expectations. Its EPS (earnings per share) of $0.26 beat the consensus estimate by 53.0%, while its revenues beat the estimate by 17.0%.

AK Steel and U.S. Steel also reported earnings beats in their 2Q17 results. U.S. Steel’s beat came after dismal 1Q17 results and the consequent fall in the stock.

In contrast, Nucor’s (NUE) and Steel Dynamics’ (STLD) earnings fell short of analysts’ expectations.

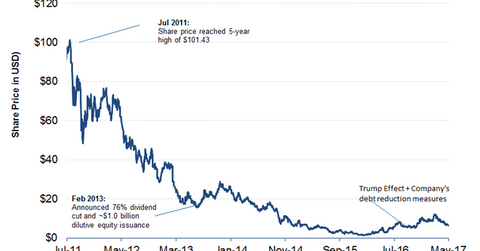

While US steel stocks have risen significantly since Donald Trump won the US presidential election, 2017 didn’t start off so well for them. Cliffs Natural Resources stock has fallen ~12.0% year-to-date as of August 2, 2017. On the one hand, volatile seaborne iron ore prices have led to price swings in CLF stock, but on the other hand, weaker-than-expected US steel prices have led to a weakening of the stock.

Series overview

We’ll analyze indicators related to the domestic US steel market as well as the seaborne iron ore market in this series. You can track these indicators to get a sense of what could drive steel prices and steelmakers in the coming months.

These indicators include US steel demand, US iron ore imports, domestic steel prices, Chinese steel demand, and seaborne iron ore demand.

Before looking at these economic indicators, we’ll look at the recent developments regarding CLF’s debt management program.