What Could Help Mead Johnson’s Earnings in 2Q16?

Analysts are expecting Mead Johnson’s adjusted EPS to be $0.78 compared to $0.76 in 2Q15.

July 22 2016, Updated 1:05 p.m. ET

Earnings expected to rise

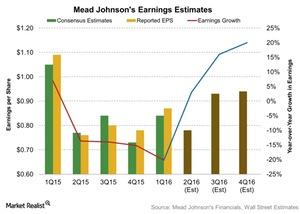

In this part, we’ll look at analysts’ EPS (earnings per share) estimates and the management’s outlook for 2016. After reporting declining earnings for the last four quarters, Mead Johnson’s earnings are expected to rise in 2Q16.

Fiscal 2Q16 EPS estimates

Analysts are expecting Mead Johnson’s adjusted EPS to be $0.78 compared to $0.76 in 2Q15. This represents a slight increase of 3%. In the chart above, you can see that since 1Q15, the company has missed estimates in two quarters. In 1Q16, it reported earnings 4% above analysts’ estimates.

Outlook for 2016

Mead Johnson expects non-GAAP (generally accepted accounting principles) EPS of $3.48–$3.60 based on current exchange rates. This estimate excludes specified items. The company expects modest single-digit EPS growth due to the strengthening dollar, which is affecting its international operations.

Earnings are expected to bounce back in the second half of 2016, making fiscal 2016 earnings growth positive. In 3Q16 and 4Q16, earnings growth is projected to be 16% and 20%, respectively.

Earnings estimates for peers

Mead Johnson’s peers in the packaged food industry include JM Smucker (SJM), Lancaster Colony (LANC), and Pinnacle Foods (PF).

- JM Smucker’s EPS for fiscal 1Q17 is expected to rise by 32%.

- Lancaster’s EPS for fiscal 4Q16 is expected to rise by 12%.

- Pinnacle’s EPS for fiscal 2Q16 is expected to rise by 9%.

To gain exposure to MJN, you can invest in the First Trust Capital Strength ETF (FTCS) or the iShares Russell Midcap ETF (IWR), which invests 2.3% of its portfolio in MJN.