How Does Take-Two Interactive Software View Fiscal 2017?

US-based Take-Two Interactive Software (TTWO) expects non-GAAP revenues in the range of $225 million–$260 million in fiscal 1Q17.

July 12 2016, Updated 6:07 p.m. ET

Revenues of $225 million–$260 million expected in fiscal 1Q17

US-based (IVV) Take-Two Interactive Software (TTWO) expects non-GAAP (generally accepted accounting principles) revenues in the range of $225 million–$260 million in fiscal 1Q17. The company expects a net loss from $0.40 per share to $0.30 per share.

According to Take-Two Interactive, revenues are expected to be lower as compared to fiscal 1Q16. This is driven by the firm’s assumption that revenue from Grand Theft Auto V and Grand Theft Auto Online will start to moderate and will be partially offset by the launch of Battleborn.

Gross margins are expected to expand above 45%. Operating expenses are expected to rise by 32% YoY (year-over-year), driven by higher marketing expenses due to the launches of Mafia III and Battleborn.

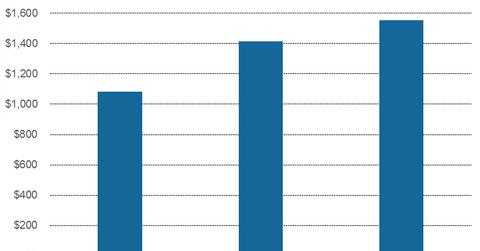

Full-year revenue

In fiscal 2017, Take-Two Interactive Software expects revenue in the range of $1.5 billion–$1.6 billion. The CFO of TTWO, Lainie Goldsteinm stated, “Our revenues are expected to be roughly unchanged as compared with last year, driven primarily by our assumptions at our new launches and expected growth from NBA 2K and WWE 2K, will be offset by moderating results from Grand Theft Auto V and Grand Theft Auto Online.”

Approximately 75% of revenues are expected to be generated from 2K and the remaining 25% from Rockstar Games. Revenues arising from the United States are expected to account for 60% of total revenues.

Take-Two Interactive Software (TTWO) accounts for 1% of the iShares S&P Small Cap 600 Growth ETF (IJT). The top holdings of this ETF include a 1.6% holding in Piedmont Natural Gas (PNY) and a 1% holding in Blackbaud (BLKB).