Robert W. Baird Downgrades UniFirst to a ‘Neutral’

UniFirst Corporation (UNF) has a market capitalization of $2.3 billion. It fell by 0.86% to close at $114.73 per share on July 1, 2016.

July 4 2016, Published 4:41 p.m. ET

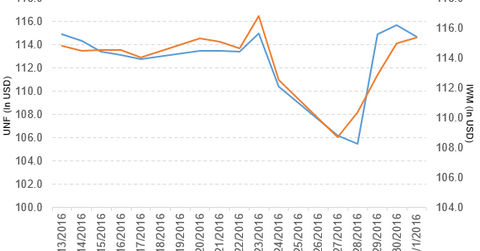

Price movement of UniFirst

UniFirst Corporation (UNF) has a market capitalization of $2.3 billion. It fell by 0.86% to close at $114.73 per share on July 1, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 3.9%, -0.72%, and 10.2%, respectively, on the same day.

UNF is trading 0.95% above its 20-day moving average, 2.1% above its 50-day moving average, and 6.5% above its 200-day moving average.

Related ETFs and peers

The iShares Russell 2000 ETF (IWM) invests 0.10% of its holdings in UniFirst. The ETF tracks a market cap–weighted index of US small-cap stocks. The index selects stocks ranked 1,001–3,000 by market capitalization. The YTD price movement of IWM was 2.8% on July 1.

The Vanguard Extended Market ETF (VXF) invests 0.04% of its holdings in UniFirst. The ETF tracks a market cap–weighted version of the S&P Total Market Index, excluding all S&P 500 stocks.

The market capitalizations of UniFirst’s competitors are as follows:

- Cintas (CTAS) — $10.6 billion

- Aramark (ARMK) — $8.1 billion

UniFirst’s rating

Robert W. Baird has downgraded UniFirst to a “neutral” from an “outperform” rating. It has also reduced the stock’s price target to $121.0 from $125.0 per share.

UniFirst’s performance in fiscal 3Q16

UniFirst reported fiscal 3Q16 revenue of $367.8 million, a rise of 0.60% compared to revenue of $365.6 million in fiscal 3Q15. Revenue from its core laundry and first aid operations rose by 1.1% and 4.6%, respectively, and revenue from its specialty garments segment fell by 6.9% compared to fiscal 3Q15.

The company’s cost of revenue as a percentage of revenue rose by 0.66%, and its income from operations fell by 8.6% compared to fiscal 3Q15.

Its net income and EPS (earnings per share) fell to $30.1 million and $1.49, respectively, in fiscal 3Q16, compared to $32.5 million and $1.61, respectively, in fiscal 3Q15.

UNF’s cash and cash equivalents rose by 25.7%, and its inventories fell by 5.1% compared to fiscal 4Q15. Its current ratio rose to 4.3x in fiscal 3Q16 compared to 3.6x in fiscal 4Q15.

Projections

The company has made the following projections for fiscal 2016:

- It expects its revenue to be in the range of $1.46 billion–$1.47 billion.

- It expects its EPS to be in the range of $5.45–$5.65.

In the next article, we’ll discuss Mondelēz International (MDLZ).