Pool Corporation’s Top and Bottom Lines Rose in 2Q16

POOL rose by 4.4% to close at $100.32 per share during the third week of July. Its weekly, monthly, and YTD price movements were 4.4%, 11.5%, and 25.0%.

July 25 2016, Published 1:21 p.m. ET

Price movement

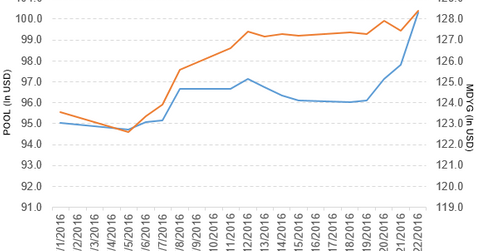

Pool Corporation (POOL) rose by 4.4% to close at $100.32 per share during the third week of July 2016. The stock’s weekly, monthly, and YTD (year-to-date) price movements were 4.4%, 11.5%, and 25.0%, respectively, as of July 22. POOL is trading 6.1% above its 20-day moving average, 9.0% above its 50-day moving average, and 19.2% above its 200-day moving average.

Related ETFs and peers

The SPDR S&P 400 Mid-Cap Growth ETF (MDYG) invests 0.57% of its holdings in Pool. The ETF tracks a market-cap-weighted index of growth companies culled from the S&P 400. The YTD price movement of MDYG was 9.0% on July 22.

The Vanguard Small-Cap ETF (VB) invests 0.10% of its holdings in Pool. The ETF tracks the CRSP US Small-Cap Index. The market-cap-weighted index includes the bottom 2%–15% of the investable universe.

The market caps of Pool’s competitors are as follows:

- Home Depot (HD)—$170.2 billion

- Beacon Roofing Supply (BECN)—$2.9 billion

Performance of Pool in 2Q16

Pool reported 2Q16 net sales of $918.9 million, a rise of 7.9%, as compared to net sales of $851.9 million in 2Q15. The company’s gross profit margin and operating income rose by 1.1% and 10.3%, respectively, in 2Q16 over 2Q15.

Its net income and EPS (earnings per share) rose to $85.4 million and $1.98, respectively, in 2Q16, as compared to $77.9 million and $1.75, respectively, in 2Q15. It reported adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) of $150.3 million in 2Q16, a rise of 10.6% over fiscal 2Q15.

Pool’s cash and cash equivalents fell by 21.3%, and its product inventories rose by 4.2% in 2Q16 over 2Q15. Its current ratio fell to 2.3x, and its debt-to-equity ratio rose to 3.5x in 2Q16, as compared to a current ratio and a debt-to-equity ratio of 2.6x and 3.3x, respectively, in 2Q15. Pool has projected the EPS in the range of $3.30–$3.45 per share for fiscal 2016.

In the next part, we’ll discuss General Mills.