How Negative Rates Intensify the Hunt for Yield

By early July, some $11.5 trillion in bonds were trading at negative rates, with 58% of the Barclays US Aggregate Bond Index1 trading below 1%.

July 27 2016, Published 5:37 p.m. ET

Negative Rates Intensify the Hunt for Yield

As unpredictable as the Brexit decision was, the fact that the resulting selloff in risk markets reversed so quickly, yet rates continued to fall, was equally difficult to forecast. The net result has been that by early July, some $11.5 trillion in bonds were trading at negative rates, with 58% of the Barclays US Aggregate Bond Index[1. The Barclays US Aggregate Bond Index is a broad-based benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS and CMBS (agency and non-agency).] trading below 1%. Thus, the hunt for yield continued as aggressively as ever. Given the impact that the more hawkish tone struck by the Federal Open Market Committee members had on debt markets in May, the rapidity of the shift back to extremely dovish expectations is somewhat unsettling and leaves one wondering how quickly expectations can swing back the other way.

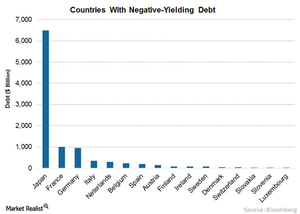

Market Realist – Sharp rise in negative-yielding global debt

Following the Brexit vote, investors seeking safety flocked to government bonds (EMLC)(EMB), which led to the sharp rise in negative-yielding global debt (PCY). According to Fitch Ratings, around $11.7 trillion worth of global bonds (BNDX)(VWOB) are trading at negative yields, a rise of 12.5% since May. The majority of these bonds were Japanese and European sovereign bonds. Negative-yielding debt with maturities of seven years or longer has nearly doubled in the second quarter to $2.6 trillion.

Fitch attributed the sharp rise in negative-yielding debt to investors’ willingness to hold on to these bonds for an extended period. In Europe, the prospect of the ECB buying Eurozone bonds in June also pushed up company debt prices. Plus, concerns over slowing global growth, coupled with large-scale bond-buying programs and negative deposit rates in areas like Japan and the Eurozone, led to a rise in negative-yielding debt recently.

Japan, which has launched aggressive stimulus measures, has the most negative yields, at $7.9 trillion as of June 30, a rise of 18% over the previous month. In the Eurozone, Germany and France are the leaders with more than $1 trillion in negative-yielding debt. German ten-year bonds are trading at -0.115% while Switzerland’s ten-year bonds are trading at -0.506%.