Can 2Q16 Mark a Turnaround for Freeport-McMoRan’s Revenues?

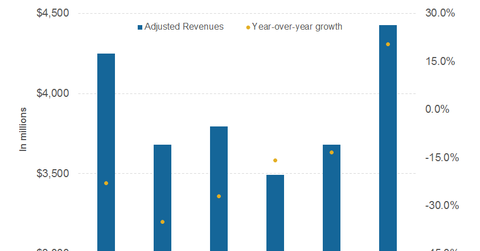

Analysts expect Freeport-McMoRan (FCX) to post revenues of ~$3.7 billion in 2Q16 and $4.4 billion in 3Q16.

July 29 2016, Updated 4:14 p.m. ET

Freeport’s revenues

According to data compiled by Bloomberg, analysts expect Freeport-McMoRan (FCX) to post revenues of ~$3.7 billion in 2Q16 and $4.4 billion in 3Q16. In contrast, Freeport posted revenues of nearly ~$4.2 billion in 2Q15 and ~$3.5 billion in 1Q16.

Analysts expect Freeport’s 2Q16 revenues to fall on a YoY (year-over-year) basis while expecting them to rise on a sequential quarterly basis. The YoY decline in revenues appears to be driven by lower commodity prices. We should note that copper prices fell steeply last year.

Freeport’s guidance

The revenues of commodity producers including BHP Billiton (BHP), Rio Tinto (RIO), and Teck Resources (TCK) are intertwined with commodity prices (GCC) and shipments. For 2Q16, Freeport gave a guidance of ~1.2 billion pounds of copper, 195,000 ounces of gold, 19 million pounds of molybdenum, and 13.5 MMboe (or million barrels of oil equivalent).

In contrast, Freeport sold nearly ~1.1 billion pounds of copper, 17 million pounds of molybdenum, 12.1 MMboe, and 201,000 ounces of gold in 1Q16.

With regard to commodity prices, copper averaged $4,729 per metric ton in 2Q16 as compared to $4,672 per metric ton in 1Q16. Brent oil prices averaged $47.70 per barrel in 2Q16 as compared to $36.70 in 1Q16.

Can Freeport beat estimates?

Notably, (FCX) expects to produce more copper and energy in 2Q16 as compared to the sequential quarter. Furthermore, the average prices of these two commodities have been higher in 2Q16 as compared to 1Q16. Looking at Freeport’s sales guidance and average commodity prices, the company’s consensus revenue estimates look somewhat conservative.

In the next part, we’ll explore what analysts are expecting from Freeport’s 2Q16 earnings.