Central and Eastern Europe Have the Brexit Blues

In the long term, Eastern Europe is largely affected by the United Kingdom’s exit from the European Union because of its strong trade links.

July 28 2016, Updated 11:08 a.m. ET

Brexit’s Impact Hardest for Central and Eastern Europe

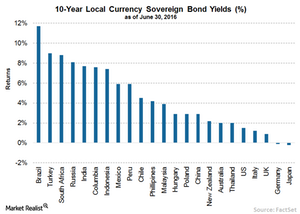

Within emerging markets, the Brexit impact, predictably, was felt most poignantly in Central and Eastern Europe. These countries have the highest dependence on Britain and the EU for trade. Romania, Poland, and Hungary were the laggards in the local currency space, while high beta countries such as Brazil, South Africa, and Colombia posted total returns (from both local interest rates and foreign currency movements) of between 10% and 15% in June alone. Despite recovering 1.8% in June, Mexico’s local debt is the only major market with a negative return year-to-date return (-2%) for the first half of 2016, all due to persistent weakness in the peso. In hard currency markets, Venezuelan debt continued to recover, returning more than 12% in June. Brazilian, South African, and Colombian sovereign and corporate U.S. dollar-denominated bonds were among the top performers as well, particularly sovereign bonds with returns in excess of 5%. That being said, overall in June, credit spreads on hard currency EM debt were only marginally tighter (virtually unchanged in the corporate markets). Duration and the U.S. Treasury rally were very much the drivers of return.

Market Realist – Higher returns in emerging markets

In the long term, Eastern Europe is significantly affected by the United Kingdom’s exit from the European Union because of its strong trade links. The United Kingdom is Poland’s third-largest trading partner while Slovakia, the Czech Republic, and Hungary’s exports to the United Kingdom constituted between 3% and 5% of their gross domestic products in 2015. If the UK economy falls into recession due to the Brexit vote, exports from Poland and other Central European countries could also fall, affecting their growth.

While most Eastern European countries continue to lag, troubled developing countries like Brazil and South Africa have posted higher returns in recent months. Investors, overlooking the slowing economic growth in these countries, flocked to buy sovereign bonds (HYEM)(PCY). The Bank of America Merrill Lynch data showed that Brazilian government bonds (EMB)(EMLC) have returned 21% year-to-date while yields have fallen to their lowest level since 2015. In order to capitalize on higher demand, Brazil’s government is planning to sell debt worth $500 million maturing in 2047 to international investors.

Venezuelan bonds have also returned handsomely with a year-to-date total return of 31.5% in dollar terms for bonds maturing in 2019. The Venezuela EMBI Global Diversified index bond spread crossed 24% over US Treasuries. Overall, EM debt (VWOB) spreads over US government bonds appear attractive, providing an average 0.6% higher returns.

Investors flocked to EM bonds, as they see very little alternative investment opportunities elsewhere—especially in developed countries. Though the risk is high in some emerging markets, they’re offering attractive yields in a market flooded with negative yields.