Bank of America Merrill Lynch Downgrades Avery Dennison

Avery Dennison (AVY) has a market capitalization of $6.5 billion. It fell by 2.9% to close at $72.62 per share on July 1, 2016.

July 4 2016, Published 4:50 p.m. ET

Price movement

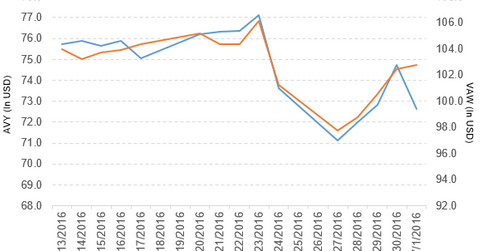

Avery Dennison (AVY) has a market capitalization of $6.5 billion. It fell by 2.9% to close at $72.62 per share on July 1, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were -1.4%, -3.5%, and 17.2%, respectively, on the same day.

AVY is trading 3.6% below its 20-day moving average, 2.7% below its 50-day moving average, and 9.6% above its 200-day moving average.

Related ETFs and peers

The Vanguard Materials ETF (VAW) invests 0.79% of its holdings in Avery Dennison. The ETF tracks a very broad market cap–weighted index of US materials companies. The YTD price movement of VAW was 10.0% on July 1, 2016.

The Vanguard Mid-Cap Value ETF (VOE) invests 0.33% of its holdings in Avery Dennison. The ETF tracks the CRSP US Mid-Cap Value Index, which classifies value stocks based on five factors.

The market capitalizations of Avery Dennison’s competitors are as follows:

Avery Dennison’s rating

Bank of America Merrill Lynch has downgraded Avery Dennison’s rating to an “underperform” from a “buy.”

Avery Dennison in fiscal 1Q16

Avery Dennison reported 1Q16 net sales of $1.49 billion, a fall of 2.8% compared to net sales of $1.53 billion in fiscal 1Q15. Sales from its pressure-sensitive materials, retail branding and information solutions, and Vancive medical technologies segments fell by 2.6%, 2.6%, and 20.2%, respectively, in 1Q16 compared to the prior year’s period.

The company’s net income and EPS (earnings per share) rose to $89.6 million and $0.98, respectively, in 1Q16, compared to $71.9 million and $0.78, respectively, in 1Q15. It reported adjusted EPS of $0.94 in 1Q16, a rise of 16.0% compared to 1Q15.

AVY’s cash and cash equivalents fell by 10.3%, and its inventories rose by 2.1% in 1Q16 compared to 1Q15. Its current ratio fell to 1.18x, and its debt-to-equity ratio rose to 3.4x in 1Q16, compared to a current ratio and a debt-to-equity ratio of 1.23x and 3.3x, respectively, in 1Q15.

Projections

The company expects its EPS to be in the range of $3.25 to $3.40 in 2016. It also expects its adjusted EPS to be in the range of $3.75–$3.90, excluding $0.20 per share in restructuring charges and other items and $0.30 per share for non-cash charges to settle US pension obligations.

In the next part, we’ll discuss Hershey.