Understanding IBM’s Value Proposition in the IT Consulting Space

IBM was trading at a forward EV-to-EBITDA multiple of ~9.25x on November 11, 2017.

Nov. 23 2017, Updated 10:30 a.m. ET

IBM’s scale in the software space

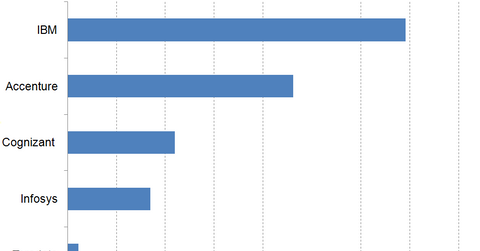

So far in the series, we discussed IBM’s performance in 3Q17. Now let’s look at the value proposition of IBM (IBM) in the IT (information technology) consulting subsector. On November 11, 2017, International Business Machines (IBM) with a market cap of $138 billion continued to be the largest player by market capitalization in the IT consulting space, followed by Accenture (ACN), which has a market cap of $92 billion, Cognizant (CTSH), India-based (EPI) Infosys, and Teradata (TDC).

Cognizant released its fiscal 3Q17 earnings on November 1, 2017. It reported revenue and EPS of $3.8 billion and $0.98, which beat analyst expectations by $10 million and $0.03, respectively. Teradata also followed IBM’s path when it came to revenue growth. Teradata released its fiscal 3Q17 earnings on November 3, 2017. Despite a YoY decline in its revenues, its fiscal 3Q17 revenues of $526 million and $0.29 beat analysts’ expectations by $14.5 million and $0.06, respectively.

Enterprise value multiples

Now let’s look at IBM’s EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) multiple. IBM was trading at a forward EV-to-EBITDA multiple of ~9.25x on November 11, 2017. This metric was lower than Accenture and Teradata’s ~11.24x and ~13.7x, respectively. The metric for Cognizant was 13.60x.

Dividend yields

IBM’s forward annual dividend yield was ~4.0% as of November 11, 2017, which was higher than Accenture and Cognizant’s forward dividend yields of ~1.9% and ~0.81%, as of November 11. Teradata doesn’t pay dividends.

In the next and final part of our series, we’ll see what kind of recommendations analysts are giving IBM.