What Analysts Are Expecting from Chipotle’s 2Q16 Earnings

In last four quarters, Chipotle has beaten analysts’ estimates three times. Usually, when the company beats analysts’ estimates, the share price rises.

July 13 2016, Updated 9:07 a.m. ET

Earnings per share

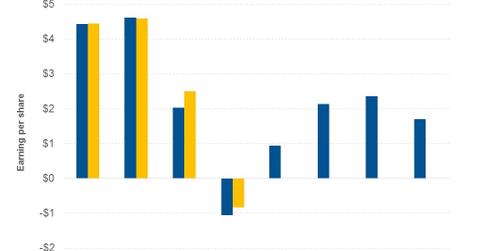

So far in this series, we’ve looked at Chipotle Mexican Grill’s (CMG) estimated revenue, sources of revenue, and estimated EBIT (earnings before interest and tax) margins. Now let’s take a look at analysts’ EPS (earnings per share) estimates.

2Q16 expectations

In last four quarters, Chipotle has beaten analysts’ estimates three times. Usually, when the company beats analysts’ estimates, the share price rises. However, in last two quarters, although Chipotle beat analysts’ estimates, its share price fell due to concerns over its future earnings on account of food safety issues.

Analysts are expecting Chipotle to post earnings per share of $0.94 in 2Q16, compared to $4.5 in 2Q15, a decline of 79%. The fall in 2Q16 revenue estimated and EBIT margins could have compelled analysts to lower their EPS estimates for 2Q16. However, share repurchases of over $1 billion are expected to mitigate some of the decline in EPS. Share repurchases reduce the number of shares outstanding, increasing EPS. Also, the 2Q16 EPS estimates show improvement from the loss of $0.84 in 1Q16.

Peer comparison

In 2Q16, peers Panera Bread (PNRA), Shake Shack (SHAK), and Brinker International (EAT) are expected to post EPS growth of 8.7%, 62.5%, and 28.1%, respectively.

Outlook

In 3Q16 and 4Q16, analysts are expecting Chipotle to post EPS of $2.1 and $2.4, respectively. Overall for fiscal 2016, analysts are expecting Chipotle’s EPS to fall 72% from $15.4 in fiscal 2015 to $4.4. The decline in revenue and EBIT margins could have prompted analysts to forecast the decline in EPS. In 1Q17, analysts are expecting Chipotle’s EPS to grow 260% to $1.7 from its 1Q16 EPS of -$0.84.

In the next part of this series, we’ll look at Chipotle’s valuation multiple.