The Word on the Street: How Analysts See JACK

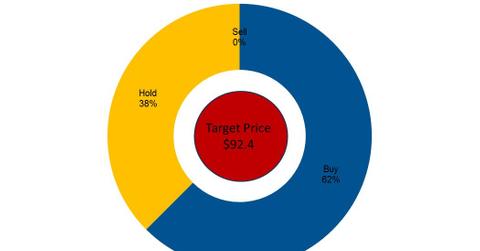

According to a Bloomberg survey of 16 analysts, 62.5% have given “buy” recommendations for JACK, and 37.5% have given “hold” recommendations.

July 7 2016, Updated 10:05 a.m. ET

Analyst target prices

As of June 24, 2016, Jack in the Box (JACK) was trading at $87.7. The share price might have already priced in the estimates that we discussed earlier in this series. In this part, we’ll look at analysts’ recommendations and estimated price targets for JACK for the next 12 months.

The rise in EPS estimates for the next four quarters and the better-than-expected 2Q16 results have prompted analysts to increase their price target for the next 12 months to $92.4 from their earlier estimate of $82.8. The new price target represents a return potential of 7.4%.

Specifically, on the higher side, David E Tarantino of Robert Baird has forecasted JACK’s share price to reach $105 in the next 12-months, with a return potential of 19.7%. On the lower side, Robert M Derrington of Telsey Advisory Group has predicted JACK’s share price to touch $85, which represents a decline of 3%.

The 12-month price targets of JACK’s peers are as follows:

Analyst recommendations

According to a Bloomberg survey of 16 analysts, 62.5% have given “buy” recommendations for JACK, and 37.5% have given “hold” recommendations.

Remember, the share prices of JACK, which makes up 0.23% of the holdings of the iShares S&P Mid-Cap 400 Growth ETF (IJK), tend to move in tandem with analyst recommendations. As analysts raise their next-12-month target prices, the share prices of the stock could also increase, and vice versa.

But remember, when a share is traded at a lower price than its target price, it doesn’t necessarily mean an automatic “buy.” Investors should carefully analyze the various matrixes that we discussed in this series before investing.