What Are Analyst Recommendations for Coca-Cola’s Stock?

As of June 17, Coca-Cola’s (KO) stock price has risen by 5.6% on a year-to-date basis.

Nov. 20 2020, Updated 12:57 p.m. ET

Year-to-date stock price movement

As of June 17, Coca-Cola’s (KO) stock price has risen by 5.6% on a year-to-date basis. The stock prices of nonalcoholic beverage peers PepsiCo (PEP), Dr Pepper Snapple (DPS), and Monster Beverage (MNST) have risen by 4.7%, -0.9%, and 8.1%, respectively, since the start of the year. As of June 17, Coca-Cola’s stock has outperformed the S&P 500 Index, which is up 2.9% since the start of the year.

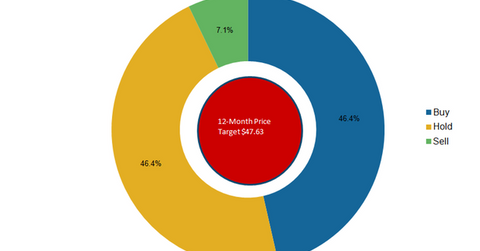

Analyst recommendations

As of June 17, 13 out of 28 analysts had a “buy” recommendation for Coca-Cola’s stock. Another 13 analysts had a “hold” recommendation, and two analysts had a “sell” recommendation. Coca-Cola exceeded analysts’ earnings expectations in 1Q16. However, the company’s EPS (earnings per share), adjusted for one-time items, have fallen for four straight quarters. With the exception of 1Q15, Coca-Cola’s revenue has fallen in each quarter since 2013.

Coca-Cola has an extensive presence in over 200 countries. This significant international presence makes the company sensitive to adverse currency fluctuations. Aside from currency headwinds, the softness in carbonated soft drink volumes is also hurting Coca-Cola’s performance. As discussed in part four of this series, the company is reshaping its strategy for carbonated (or sparkling) beverages. Coca-Cola constitutes about 2% of the iShares Global 100 ETF (IOO).

Growth strategy

With sparkling beverages losing their fizz, Coca-Cola is expanding its presence in the growing still beverage category. On June 1, the company along with its key bottler announced the acquisition of Unilever’s (UL) AdeS, a soy-based beverage business. In January 2016, the company announced the acquisition of a minority stake in Chi Limited, Nigeria’s leading dairy, juice, and snacks company. In 2015, the company purchased a ~30% stake in Suja Juice, a California-based manufacturer of organic juice. The company also marked its presence in plant-based protein drinks with the acquisition of the beverage business of China Green Culiangwang Beverages Holdings.

Coca-Cola is also implementing several initiatives to improve its margins, including refranchising its bottling operations. As of June 17, the 12-month price target for Coca-Cola’s stock is $47.63, which reflects a 6.3% growth potential.

For more updates, visit our Nonalcoholic Beverages page.