What Caused US Crude Oil Inventories to Fall Marginally?

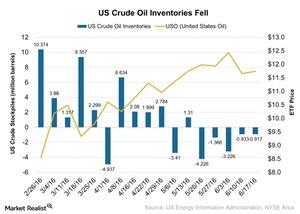

According to the EIA’s report on June 22, 2016, US crude oil inventories fell by 0.92 MMbbls (million barrels) for the week ending June 17, 2016.

June 27 2016, Published 12:18 p.m. ET

US crude oil inventories fell by 0.92 MMbbls

According to the U.S. Energy Information Administration’s report on June 22, 2016, US crude oil inventories fell by 0.92 MMbbls (million barrels) for the week ending June 17, 2016—compared to a decline of 0.93 MMbbls in the previous week. The Market expected a decline of 1.7 MMbbls. It didn’t meet the Market expectations. It declined for the fifth consecutive week.

The United States Oil ETF (USO) fell 1.2% and the ProShares Ultra Bloomberg Crude Oil ETF (UCO) fell 2% on June 22, 2016. Inventory reports didn’t meet the Market expectations.

What’s dragging crude oil’s movement?

The United Kingdom’s referendum is over. In the last week, volatility increased in the Market before the referendum. The referendum was held on June 23 and the results came out on June 24. The United Kingdom (EWU) voted to leave the European Union. This dragged down global markets (ACWI). All of the global markets ended in red on June 24, 2016.

Crude oil fell nearly 6% after the results were announced. The fall in crude oil indicates that there is uncertainty in the economy. The United Kingdom’s economic growth might be hampered in the near future. It won’t get the minimized trade barriers to trade with the European Union. The economic demand for crude oil might fall in the near future. Crude oil fell due to these expectations. At the same time, gold (GLD) jumped 6%. The sudden increase in gold indicates that global economic growth will be under pressure.

In the next part of this series, we’ll analyze the United Kingdom’s referendum results. We’ll see how the results could impact the global economy.