What Strengths Differentiate 3M Company from the Competition?

3M Company is generating a massive 30%–32% of its annual revenue from products it’s introduced in the last five years.

June 24 2016, Updated 9:06 a.m. ET

An R&D powerhouse

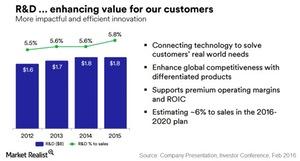

3M Company (MMM) has historically invested about 5%–6% of its sales in research and development (or R&D). Based on the figures provided by the company’s CEO Inge Thulin, 3M is generating a massive 30%–32% of its annual revenue from products it’s introduced in the last five years.

Therefore, it goes without saying that 3M’s R&D investments have played a stellar role in the company’s new product development and profitability maximization. Note that cannibalization is quite significant within its portfolio, as it purposefully replaces existing products with shorter patent lives with new products so that it can maintain its high operating margins.

The useful lives of 3M’s patents varies between five and 13 years. Given that competitors find it tough to match the company’s R&D investments in dollar amounts, let alone in quality and value, 3M’s R&D pipeline presents it with a formidable sustainable advantage.

Economies of scale and scope

3M’s mammoth scale enables the company to source raw materials at lower costs than its competitors. The company’s major fixed costs are spread out over a wider sales base, translating to lower selling and administrative costs per unit of sales.

3M also benefits from economies of scope, as several businesses share the same manufacturing assets within the enterprise. Companies that majorly compete with 3M on costs would still rake in lower margins, even if they were to match 3M’s pricing for its products.

In reality, consumers are often willing to pay an extra amount for a premium brand, so competitors without 3M’s scale would have abysmally low margins.

Key ETFs

Investors interested in trading in the industrials space can look into the Vanguard Industrials ETF (VIS) and the Industrial Select Sector SPDR ETF (XLI).

Major holdings in VIS include General Electric (GE) with a weight of 12.2%, 3M Company with a weight of 4.3%, and United Technologies (UTX) with a weight of 3.7%.