What Strategy Is 3M Company Using to Increase Cost Savings?

Realizing that its capital structure was sub-optimal and was leading to a high cost of capital, 3M Company started adding leverage.

July 12 2016, Updated 6:04 p.m. ET

Capital structure optimization

Realizing that its capital structure, which had debt of 1.92 times equity in 2013, was sub-optimal and was leading to a high cost of capital, 3M Company (MMM) started adding leverage. This led to a rise in its leverage, with debt at 2.6 times equity in 2015.

In its bid to further reduce its cost of capital, the company intends to add $10 billion–$15 billion incrementally over the next five years. This shift in capital structure is expected to erode 3M’s earnings per share by 1% in the 2016–2020 period.

Cost savings from supply chain management and business transformation

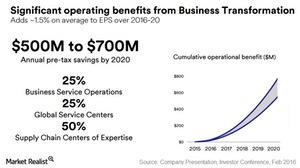

3M intends to spend between $500 million and $600 million to optimize its supply chain footprint. These investments are expected to deliver recurring cost savings of $125 million–$175 million by 2020 and to reduce the company’s aggregate inventory by $100 million.

Apart from supply chain initiatives, 3M’s business transformation from implementing global service centers and business service operations is expected to deliver additional recurring savings of $325 million–$375 million by 2020. The transformation is also expected to reduce the company’s aggregate inventory by another $400 million.

3M is optimizing business service operations by establishing them centrally and supplementing them with regional capabilities around the world. These measures have enabled the company to consolidate its customer-centered processes.

Key ETFs

Investors interested in trading in the industrials space can look into the Vanguard Industrials ETF (VIS) and the Industrial Select Sector SPDR ETF (XLI). Major holdings in VIS include General Electric (GE) with a weight of 12.2%, 3M Company with a weight of 4.3%, and United Technologies (UTX) with a weight of 3.7%.