What Are American Airlines’ Key Revenue Streams?

In this part of the series, we’ll look at the main services and categories that add to American Airlines’ (AAL) revenues. The major component of revenues still comes from airfares.

June 17 2016, Updated 11:05 a.m. ET

Airfares

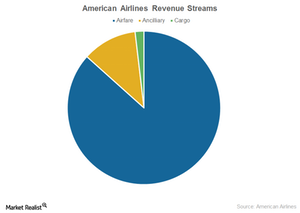

In this part of the series, we’ll look at the main services and categories that add to American Airlines’ (AAL) revenues. The major component of revenues still comes from airfares. Airfare is the base ticket price an airline charges its customers, depending on the route and the day of travel.

In the past year or so, airlines have been under pressure to keep their airfares low, since higher fares would dampen the demand for travel.

For the past few years, airfare has formed ~87% of AAL’s revenues. It was 91% in the early 2000s.

Ancillary fees

In addition to the base ticket price, airlines are now charging ancillary fees. These include additional costs for advance seat assignments, carry-on luggage, in-flight beverages, entertainment, and more. These revenues now make up a substantial portion of airlines’ total incomes.

Airlines have been studying customer behavior to add more services and, in turn, more fees. American Airlines is exceptionally good at extracting fees from their customers. It’s among the top five airlines in terms of ancillary revenues.

Airline credit cards and loyalty program

American Airlines attributes much of its “other” revenue to the sale of mileage credits in its AAdvantage frequent flyer program. It’s the oldest program in the airline industry. However, it’s been facing stiff competition from other airlines, and its charm has been fading.

With the AAdvantage program, the award availability is largely controlled by the pricing department and what kind of demand for seats the airline estimates. This means that at peak demand times, the availability of free seats declines.

The airline’s saver-level seats availability has fallen from 67% in 2015 to only 56% of booking queries, pushing it farther behind in terms of value to customers. Since the program is a major revenue contributor, it may need some attention.

Ancillary fees and credit cards have formed 11%–12% of AAL’s revenue in the last few years. This compares to 5%–6% in 2005.

Cargo revenue

Airlines also earn revenue from freight and mail services. AAL’s cargo revenue has declined from 4% in 2005 to 2% in 2015.

You can gain exposure to airlines by investing in the PowerShares Dynamic Leisure & Entertainment ETF (PEJ). PEJ holds 5% in Southwest Airlines (LUV), 4.6% in Delta Air Lines (DAL), 4% in United Continental (UAL), and 4% in AAL.

Now let’s take a look at American Airlines’ revenue segments.