Inside Neurocrine Biosciences’ Analyst Recommendations in 2016

Based on the recommendations of eight brokerage firms, a Bloomberg survey reported that 100% of analysts gave Neurocrine Biosciences “buy” recommendations.

June 29 2016, Published 5:09 p.m. ET

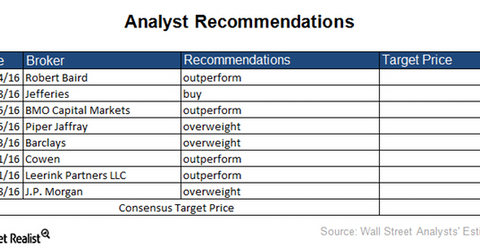

Analyst recommendations

Based on the recommendations of eight brokerage firms, a Bloomberg survey reported that 100% of analysts gave Neurocrine Biosciences (NBIX) a “buy” recommendation. In addition to this investor confidence, the company is also enjoying a a strong support from the analyst community.

The consensus 12-month target price for the stock is $68.25, which represents a rise of 63.3% from the stock’s last price of $41.79 on June 28, 2016. If Neurocrine Biosciences’ share price manages to reach this price target, it could also have a positive impact on the PowerShares Dynamic Biotechnology & Genome Portfolio (PBE). Neurocrine Biosciences makes up about 2.8% of PBE’s total portfolio holdings.

Robust drug pipeline

The strong analyst recommendations for Neurocrine Biosciences are based on the company’s robust drug pipeline as well as on its high probability of receiving approval from the US Food and Drug Administration for its TD (tardive dyskinesia) drug, Valbenazine. According to statistics by Kantar Health, IMS Health, and Truven Health Analytics, there are ~500,000 patients suffering from TD while 280,000 suffer from a moderate to severe version of the disease.

There is also no standard of care present to serve this unmet demand. Forecasts of expanding market opportunities due to the correct diagnosis of the disease have played a key role in increasing analyst confidence in Neurocrine Biosciences’ future growth prospects.

Peer comparisons

Based on a Bloomberg survey of 13 broker firms, Horizon Pharma (HZNP) received “buy” recommendations from 83.3% of firms and “hold” recommendations from 8.3% of firms. Only 8.3% of firms rated Neurocrine Biosciences a “sell.”

Among the 14 brokerage firms surveyed by Bloomberg for Ionis Pharmaceuticals (IONS), 38.5% gave it a “buy,” while 53.8% gave it a “hold,” and 7.7% gave it a “sell.”

Based on the recommendations of 17 broker firms in a Bloomberg survey, Mallinckrodt Pharmaceuticals (MNK ) received “buy” recommendations from 87.5% of firms and “hold” recommendations from 12.5% of firms. None of the firms rated Mallinckrodt Pharmaceuticals as a “sell.”

In the next part, we’ll explore data from the Kinect 3 study.