Inside FIS’s Operating Model

In 2015, FIS reorganized and began reporting its results under three segments. But after the SunGard acquisition, another restructuring process is underway.

June 1 2016, Published 2:58 p.m. ET

Business model

Fidelity National Information Services (FIS) offers a broad spectrum of financial software solutions to financial and non-financial institutions. The company’s services include the following:

- retail and enterprise banking

- payments

- asset and wealth management

- capital markets

- treasury

- insurance

- risk and compliance

FIS also provides financial consulting and outsourcing services.

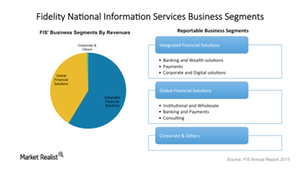

In 2015, the company reorganized and began reporting its results under three segments. However, after the SunGard acquisition, another restructuring process is underway and may result in a change in reporting segments in 2016. The company now reports its results under three major segments made up of six core areas of operations:

- Integrated Financial Solutions

- Global Financial Solutions

- Corporate & Other

Integrated Financial Solutions

This segment focuses on serving North American regional and community banks with account processing, payment solutions, digital channels, risk and compliance, and other products.

This segment focuses on three core areas of operation: Banking and Wealth Solutions, Payments, and Corporate and Digital Solutions. In 2015, this segment contributed ~60% to FIS’s revenues.

Global Financial Solutions

The GFS (Global Financial Solutions) segment focuses on serving clients across the globe with banking and payment solutions as well as consulting and transformation services. GFS segment focuses on three key operational areas- Institutional and wholesale, banking and payment and consulting solutions. In 2015, this segment contributed ~40% to FIS’s revenues.

This segment has expanded its reach through the acquisition of SunGard. As a result of the SunGard acquisition, it delivers capital market and asset management solutions, insurance, public sector, and education solution services.

Corporate & Other

This segment consists of corporate overhead expenses, certain leverage functions, and miscellaneous expenses that are not accounted for under other segments. Expenses related to sales, human resources, and finance that are not directly attributable to the other operating segments are allocated to this segment.

FIS’s major competitors in the financial software solutions business include Fiserv (FISV) and Jack Henry & Associates (JKHY). Investors interested in diversified exposure to these stocks could invest in the SPDR S&P 500 ETF (SPY) or the SPDR Technology ETF (XLK).

Continue to the next part for a closer look at FIS’s Integrated Financial Solutions Segment.