Why Church & Dwight Sold Its Brands to Armaly Brands

Church & Dwight (CHD) has a market cap of $12.7 billion. It fell by 0.74% to close at $99.14 per share on June 13, 2016.

June 15 2016, Updated 9:06 a.m. ET

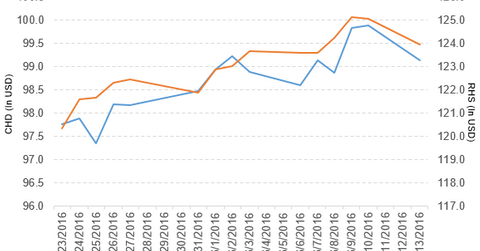

Price movement of Church & Dwight

Church & Dwight (CHD) has a market cap of $12.7 billion. It fell by 0.74% to close at $99.14 per share on June 13, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 0.54%, 1.8%, and 17.7%, respectively, on the same day. This means that CHD is trading 1.0% above its 20-day moving average, 3.9% above its 50-day moving average, and 12.7% above its 200-day moving average.

Related ETF and peers

The Guggenheim S&P 500 Equal Weight Consumer Staples ETF (RHS) invests 2.5% of its holdings in Church & Dwight. RHS tracks an equal-weighted index of large-cap US consumer staples stocks drawn from the S&P 500. The YTD price movement of RHS was 6.8% on June 13, 2016.

The market caps of Church & Dwight’s competitors are as follows:

Church & Dwight has sold its assets

Church & Dwight has sold its Cameo, Snobol, and Parsons brands and assets to Armaly Brands, the maker of the Brillo cleaning brand. Armaly is planning to invest in marketing these brands and expanding the North American and global distribution.

Performance in fiscal 1Q16

Church & Dwight reported fiscal 1Q16 net sales of $8.5 billion, an increase of 4.5% compared to net sales of $8.1 billion in fiscal 1Q15. The company’s cost of sales as a percentage of net sales fell by 1.8%, and its operating income rose by 4.3% in fiscal 1Q16 compared to fiscal 1Q15.

Its net income and EPS (earnings per share) rose to $1.13 billion and $0.86, respectively, in fiscal 1Q16 compared to $1.07 billion and $0.80, respectively, in fiscal 1Q15.

Church & Dwight’s cash and cash equivalents fell by 41.1%, and its inventories rose by 6.2% in fiscal 1Q16 compared to fiscal 4Q15. Its current ratio fell to 0.78x, and its DE (debt-to-equity) ratio rose to 1.2x in fiscal 1Q16 compared to a current ratio and DE ratio of 1.0x and 1.1x, respectively, in fiscal 4Q15.

Projections

Church & Dwight has made the following projections for fiscal 2016:

- organic sales growth of 3%–4% due to the introduction of new products in its core business

- gross margin of ~0.75% due to lower commodity costs, productivity programs, and the reduction of vitamin startup costs

- operating margin expansion of ~0.50%

- free cash flow of 125% compared to net income

- adjusted EPS growth of 7%–9%

The company made the following projections for fiscal 2Q16:

- organic sales growth of 2%–3%

- margin expansion and adjusted EPS of $0.79 per share

- reported EPS growth of 44%

The company will also have some new products, including Arm & Hammer Clump & Seal MicroGuard, dual chamber unit dose laundry detergent, a new beauty line of adult vitamins, and a new Riviera lubricant.

In the next and final part of our series, we’ll take a look at Estée Lauder (EL).