The Catalysts Powering Nike’s Growth Performance in Fiscal 2016

Nike (NKE) is expected to post sales of $8.3 billion in fiscal 4Q16, an increase of 6.4% year-over-year, according to the Wall Street analysts’ consensus.

Nov. 22 2019, Updated 5:41 a.m. ET

Sales expectations from Nike in fiscal 4Q16

Nike (NKE) is expected to post sales of $8.3 billion in fiscal 4Q16, an increase of 6.4% year-over-year, according to Wall Street analysts’ consensus estimates.

Nike’s growth guidance projects a mid-single-digit rise in fourth quarter sales, which is in line with the growth rate experienced by the firm in the first three quarters of fiscal 2016. That’s lower than its historical CAGR (compound annual growth rate) of 10% in the last five years.

Nike also expects to grow future sales at a higher pace, to $50 billion by fiscal 2020. This implies a CAGR of 10.3% in the next five years.

Nike’s sales growth in fiscal 2016 has been hit by currency headwinds, primarily in the European, Latin America, and Asian markets, as we discussed earlier in this series. The company derived about 54% of its sales from overseas markets in fiscal 2015.

Geographic analysis

North America was the biggest growth contributor to Nike’s (NKE) sales growth in the first three quarters of fiscal 2016, accounting for 6% of its revenue growth. This was followed by Greater China, contributing 3% to its growth, and Western Europe contributing 2% to its revenue growth.

Among the other athletic gear firms, Under Armour (UA), Lululemon Athletica (LULU), Skechers (SKX), Puma (PMMAF), and Adidas (ADDYY) have also reported seeing strong traction in these markets in the last few quarters, boosted by the growth in sports participation and fitness activities.

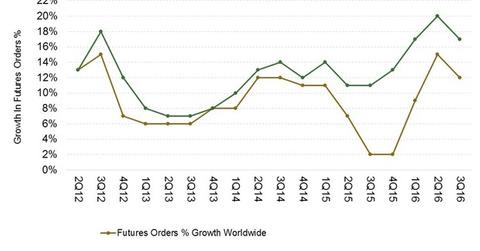

Nike’s future orders trends also appear strong across geographies. The company expects to see double-digit growth (IVW) in each geographic segment in currency-neutral terms.

In reported terms, all segments are expected to post double-digit growth, with the exception of Central and Eastern Europe, as well as emerging markets, according to future orders trends.