A Look at C. R. Bard’s Oncology Business Segment

C. R. Bard’s (BCR) Oncology segment contributes around 27% of the total revenues of the company.

June 8 2016, Updated 1:05 a.m. ET

An overview of C. R. Bard’s Oncology segment

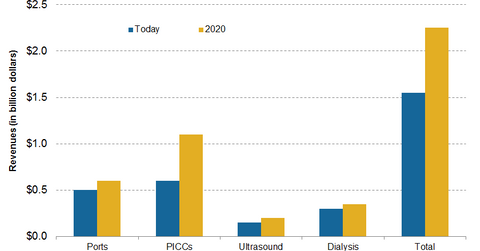

C. R. Bard’s (BCR) Oncology segment contributes around 27% of the total revenues of the company. The segment reported an increase of ~3% in net sales in 2015. The segment’s portfolio comprises specialty vascular access products and enteral feeding devices. Specialty vascular access products include PICCs (peripherally inserted central catheters), specialty access ports, dialysis access catheters, and vascular access ultrasound devices. PICC products are the major growth drivers of the Oncology segment.

Key growth drivers

In 2015, whereas US net sales in the oncology segment increased by approximately 3%, there was a 2% growth in international sales. However, on a constant currency basis, international revenues increased by ~13%. PICC sales grew by ~8% in 2015, whereas port sales declined by ~6%. The net sales of dialysis access catheters and vascular access ultrasound devices increased by ~5% in 2015.

C. R. Bard’s Oncology segment’s future growth is expected to be driven primarily by the expansion of its PICC product segment and its penetration in international markets. The company has an 80% share of the PICC market in the United States. Moreover, US PICC sales grew by over 30% in 2015. The Oncology segment is the primary revenue generator in the company’s business in China.