What Boosted Under Armour on June 7?

Under Armour rose by 2.6% to close at $37.77 per share on June 7. Its weekly, monthly, and YTD price movements were 0.11%, -2.4%, and -6.3%, respectively.

June 9 2016, Updated 4:05 p.m. ET

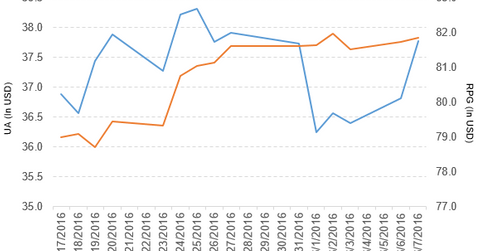

Price movement of Under Armour

Under Armour (UA) has a market cap of $6.9 billion. It rose by 2.6% to close at $37.77 per share on June 7, 2016. The stock’s weekly, monthly, and YTD (year-to-date) price movements were 0.11%, -2.4%, and -6.3%, respectively, as of the same day.

This means that UA is trading 0.84% above its 20-day moving average, 7.5% below its 50-day moving average, and 12.2% below its 200-day moving average.

Related ETF and peers

The Guggenheim S&P 500 Pure Growth ETF (RPG) invests 1.2% of its holdings in Under Armour. RPG tracks an index of primarily large- and mid-cap companies with strong growth characteristics. The index selects companies from the S&P 500 Index based on three growth factors. The YTD price movement of RPG was 1.4% as of June 7, 2016.

The market caps of Under Armour’s competitors are as follows:

Under Armour’s new mobile app

Under Armour rose by more than 2.6% on June 7, 2016, after the launch of its first mobile app, UA Shop. The app should improve the consumer shopping experience based on the Under Armour Connected Fitness platform and will also provide experience based on athlete inspiration, workout history, and previous purchase history.

Performance of Under Armour in 1Q16

Under Armour (UA) reported 1Q16 net revenues of $1.1 billion, which is a rise of 30.2% over the net revenues of $804.9 million it saw in 1Q15. Revenues from its Apparel, Footwear, Accessories, Licensing, and Connected Fitness segments rose by 20.0%, 64.2%, 26.2%, 14.7%, and 119.4%, respectively, in 1Q16 over 1Q15.

The company’s cost of goods sold as a percentage of net revenue and income from operations rose by 1.9% and 26.0%, respectively, in 1Q16 compared to 1Q15. Its net income and EPS (earnings per share) rose to $19.2 million and $0.04, respectively, in 1Q16. This compares to the $11.7 million and $0.03, respectively, the company saw in 1Q15.

Under Armour’s cash and cash equivalents and inventories rose by 20.9% and 6.6%, respectively, in 1Q16 over 4Q15. Its current ratio fell to 2.9x, and its debt-to-equity ratio rose to 0.85x in 1Q16. This compares to its current ratio and a debt-to-equity ratio of 3.1x and 0.72x, respectively, in 4Q15.

Projections

For 2016, Under Armour (UA) has issued the following revised projections:

- net revenues: ~$4.9 billion

- operating income: $440 million–$445 million

- interest expense: ~$35 million

- effective tax rate: ~38.5%

- fully diluted weighted average shares outstanding: ~446 million of the Class C stock dividend

For 2Q16, Under Armour (UA) has issued the following revised projections:

- an impairment charge of ~$23 million related to the closing of retailer Sports Authority

- revenue growth in the high 20% range

- operating income of $17 million–$19 million

- tax rate of ~70%

These projections include the bankruptcy and liquidation of the Sports Authority retail chain.

In the next and final part, we’ll take a look at Ford Motor.