Under Armour Has Declared a Dividend for Its Class C Stock

Under Armour (UA) has a market cap of $6.7 billion. It fell by 0.44% to close at $36.40 per share on June 3, 2016.

June 6 2016, Published 12:59 p.m. ET

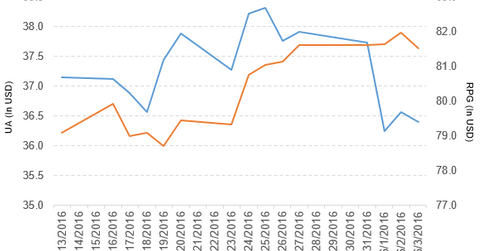

Price movement of Under Armour

Under Armour (UA) has a market cap of $6.7 billion. It fell by 0.44% to close at $36.40 per share on June 3, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were -3.6%, -7.9%, and -9.7%, respectively, as of the same day. This means that UA is trading 3.5% below its 20-day moving average, 11.3% below its 50-day moving average, and 15.7% below its 200-day moving average.

Related ETF and peers

The Guggenheim S&P 500 Pure Growth ETF (RPG) invests 1.2% of its holdings in Under Armour. It tracks an index of primarily large-caps and mid-caps with strong growth characteristics. It selects companies from the S&P 500 Index based on three growth factors. The YTD price movement of RPG was 1.0% as of June 3, 2016.

The market caps of Under Armour’s competitors are as follows:

Under Armour declared a dividend

Under Armour has declared a $59 million dividend to shareholders of its Class C non-voting common stock. This is to satisfy the settlement agreement with shareholders related to the creation of Class C stock. The company will pay the dividend in the form of additional shares of Class C stock, with cash in lieu of any fractional shares. The shares will be distributed on or about June 29, 2016, to shareholders of record at the close of business on June 15, 2016.

Under Armour determined the initial distribution ratio as 0.007098 of a share of Class C stock for each share of Class C stock held.

Performance of Under Armour in 1Q16

Under Armour (UA) reported 1Q16 net revenue of $1.1 billion, a rise of 30.2% compared to net revenue of $804.9 million in 1Q15. Revenues from its Apparel, Footwear, Accessories, Licensing, and Connected Fitness segments rose by 20.0%, 64.2%, 26.2%, 14.7%, and 119.4%, respectively, in 1Q16 compared to 1Q15.

The company’s cost of goods sold as a percentage of net revenue and income from operations rose by 1.9% and 26.0%, respectively, in 1Q16 compared to 1Q15.

UA’s net income and EPS (earnings per share) rose to $19.2 million and $0.04, respectively, in 1Q16. This is compared to $11.7 million and $0.03, respectively, in 1Q15.

Under Armour’s cash and cash equivalents and inventories rose by 20.9% and 6.6%, respectively, in 1Q16 compared to 4Q15. Its current ratio fell to 2.9x, and its debt-to-equity ratio rose to 0.85x in 1Q16. This compares to its a current ratio and a debt-to-equity ratio of 3.1x and 0.72, respectively, in 4Q15.

Projections

For 2016, Under Armour (UA) has issued the following revised projections:

- net revenues: ~$4.9 billion

- operating income: $440 million–$445 million

- interest expense: ~$35 million

- effective tax rate: ~38.5%

- fully diluted weighted average shares outstanding: ~446 million of the Class C stock dividend

For 2Q16, Under Armour (UA) has issued the following revised projections:

- impairment charge of ~$23 million related to the closing of retailer Sports Authority

- revenue growth in the high 20% range

- operating income of $17 million–$19 million

- tax rate of ~70%

These projections include the bankruptcy and liquidation of the Sports Authority retail chain.

In the next part, we’ll take a look at Nu Skin Enterprises.