How Amazon’s Marketplace Is Driving Its Gross Margins

The growing number of third-party sellers on Amazon Marketplace is one of the key factors driving the company’s expansion in its gross margin.

June 17 2016, Updated 11:04 a.m. ET

Third-party sellers on Amazon are boosting gross margins

In this part of the series, we’ll focus on Amazon’s (AMZN) third pillar of growth, its Marketplace platform. The growing number of third-party sellers on Amazon Marketplace is one of the key factors driving the company’s expansion in its gross margin. Amazon’s strategic push toward growing its fulfillment capacity is further expected to drive its margins in the coming years.

As stated earlier in the series, Amazon launched its Marketplace platform about 15 years ago to provide third-party sellers access to millions of shoppers.

These third-party sellers largely benefit Amazon, as the gross margins associated with these transactions are very high. The company stated that in 2015, about 50% of units sold on Amazon were sold by third-party sellers. This number was 48% in 1Q16.

Amazon’s fulfillment cost increased consistently

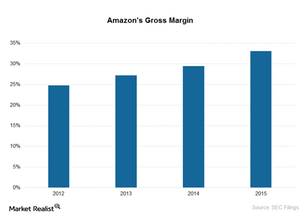

The chart above shows that Amazon’s gross margin has grown steadily. The company’s fulfillment cost has also grown rapidly. The year-over-year growth rate of this cost rose from 19% in 1Q15 to 34% in 1Q16.

Fulfillment centers allow sellers to sell their products under the Fulfillment by Amazon (or FBA) program. The company considers FBA to be an important growth driver, as it provides customers with a variety of products to select from. Selection growth makes Amazon’s Prime program more valuable to customers.

The PowerShares NASDAQ Internet Portfolio ETF (PNQI) is a portfolio of 94 stocks. Its four top stocks are Amazon, Facebook (FB), Alphabet (GOOG), and Baidu (BIDU), which constitute 9.5%, 8.1%, 7.7%, and 7.5% of the fund, respectively.