The Next Chapter in Union Pacific’s Carload Slump

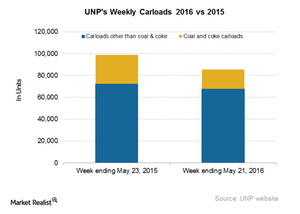

In the week ending May 21, Union Pacific’s total railcars declined by 13.5% YoY to ~86,000 units, which was down from ~99,000 units one year previously.

June 10 2016, Updated 10:04 a.m. ET

Carloads

Union Pacific (UNP) competes with Berkshire Hathaway’s BNSF Railway (BRK-B) in the western United States. In the week ending May 21, UNP’s total railcars declined by 13.5% YoY (year-over-year) to ~86,000 units, which was down from ~99,000 units one year previously.

Railcars excluding coal and coke railcars declined by 6.5% during the week. Overall, UNP’s fall in total railcars was higher than the ~10.6% fall in reporting US railroads’ railcars.

Why coal carloads matter

Union Pacific’s combined coal and coke carloads declined by roughly 33% in the latest reported week of 2016, on a year-over-year basis. The company moved ~18,000 coal and coke carloads in the week ending May 21, 2016, as compared to ~27,000 units one year previously. UNP also recorded a decline of 22% in coal revenues for 2015, and coal’s share of the company’s revenues was almost 16% in 2015.

UNP’s coal revenues depend on coal shipments originating in the Southern Powder River Basin, or PRB. According to the US government, PRB production has declined over the past few years, mainly due to recession and competition from natural gas. PRB coal output is expected to fall significantly in 2016—for the first time since 1998. Competition from natural gas due to low natural gas prices has been one of the main factors affecting coal output recently.

Major coal producers operating in that area, such as Alliance Resource Partner (ARLP), Peabody Energy (BTU), and CONSOL Energy (CNX), are facing significant coal demand headwinds in 2016. BTU filed Chapter 11 bankruptcy in the US on April 13.

Investors might consider the iShares Global Industrials ETF (EXI) for exposure to US railroads. All US-originated Class I railroads are included in the portfolio holdings of EXI.

Commodity groups

Commodities that ended the week of May 21 in the green zone include the following:

- grain

- non-metallic minerals

- stone, clay, and glass products

Commodities ending the week in the red zone were farm products except grain, motor vehicles and equipment, crushed stone, gravel and sand, primary forest products, and petroleum products.

Now let’s look at UNP’s intermodal traffic.