How Did Ralph Lauren Perform in 2Q17?

Ralph Lauren (RL) reported fiscal 2Q17 net revenues of ~$1.8 billion, a fall of 7.6% compared to net sales of ~$2.0 billion in fiscal 2Q16.

Nov. 14 2016, Updated 11:04 a.m. ET

Price movement

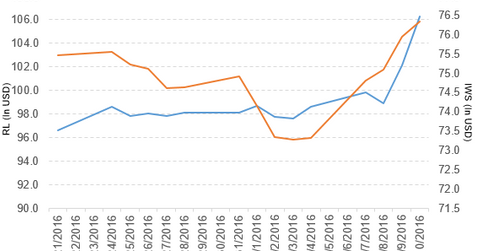

Ralph Lauren (RL) has a market cap of $8.8 billion. It rose 4.0% to close at $106.26 per share on November 10, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 8.8%, 4.5%, and -3.1%, respectively, on the same day.

RL is trading 8.0% above its 20-day moving average, 6.6% above its 50-day moving average, and 10.8% above its 200-day moving average.

Related ETF and peers

The iShares Russell Mid-Cap Value ETF (IWS) invests 0.16% of its holdings in Ralph Lauren. The ETF tracks an index of US midcap value stocks. The index selects from the bottom 80% of the Russell 1000, screening on value factors. The YTD price movement of IWS was 12.9% on November 10.

The market caps of Ralph Lauren’s competitors are as follows:

Performance of Ralph Lauren in fiscal 2Q17

Ralph Lauren (RL) reported fiscal 2Q17 net revenues of ~$1.8 billion, a fall of 7.6% compared to net sales of ~$2.0 billion in fiscal 2Q16. Revenue from its Wholesale and Retail segments fell 10.4% and 5.4%, respectively. Revenue from its Licensing segment rose 2.1% in fiscal 2Q17 compared to fiscal 2Q16.

The company’s gross profit margin and operating margin narrowed by 410 basis points and 750 basis points, respectively, in fiscal 2Q17 compared to fiscal 2Q16.

Ralph Lauren’s net income and EPS (earnings per share) fell to $45.0 million and $0.55, respectively, in fiscal 2Q17 compared to $160.0 million and $1.86, respectively, in fiscal 2Q16. The company reported adjusted EPS of $1.90 in fiscal 2Q17, a fall of 10.8% compared to fiscal 2Q16.

Ralph Lauren’s cash and cash equivalents fell 4.8%, and its inventories rose 4.3% in fiscal 2Q17 compared to fiscal 4Q16. Its current ratio fell to 2.4x, and its debt-to-equity ratio rose to 0.69x in fiscal 2Q17, compared to a current ratio and a debt-to-equity ratio of 2.5x and 0.66x, respectively, in fiscal 4Q16.

Projections

Ralph Lauren (RL) has made the following projections for fiscal 3Q17:

- consolidated net revenues to fall to low double digits to low teens

- tax rate of ~29%

- operating margin to fall ~2.0%–2.25% compared to fiscal 3Q16

The company has made the following projections for fiscal 2017:

- consolidated net revenues to fall at a low double-digit rate, including a proactive pullback in inventory receipts, store closures, pricing harmonization, and sale initiatives

- operating margin of ~10%

- tax rate of ~29%

- annualized expense savings of $180 million–$220 million from restructuring activities related to changes in the organizational structure and right-sizing its cost structure and real estate portfolio

In the final part of this series, we’ll look at Newell Brands (NWL).