Why Monetary Policy Isn’t Enough to Boost the Japanese Economy

The BoJ is the one of the largest holders of Japanese (DFJ) government bonds and also a major player in equity markets.

June 6 2016, Updated 11:06 a.m. ET

We still hold a neutral view of the market, however. We believe monetary policy, the first arrow of Prime Minister Shinzo Abe’s “three-arrow” economic plan, isn’t enough to boost the local economy and market. The BoJ still has ammunition left to raise inflation expectations, including increased equity purchases, despite last week’s inaction.

Market Realist – Abe’s strategy isn’t working

When Shinzo Abe became Japan’s (EWJ)(DXJ) prime minister in December 2012, he announced a three-pronged strategy to target low inflation and lackluster economic growth. The strategy mainly comprises three components: easy monetary policy, fiscal stimulus, and structural reforms. But it has failed to solve Japan’s (SCJ)(HEWJ) immediate problems. The economy has fallen back into deflation while real GDP has also fallen. The fiscal deficit, though it improved a bit since Abe took office, is still very high at 6% of GDP in 2015 while debt is at 230% of GDP.

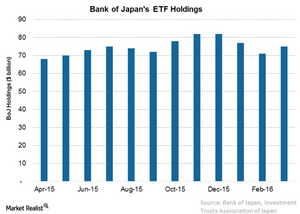

Though the BoJ has yet to have any meaningful impact on economic growth, it still can influence inflation expectations by measures such as asset purchases. The BoJ is the one of the largest holders of Japanese (DFJ) government bonds and also a major player in equity markets. It’s now a top-ten shareholder in about 90% of stocks and owns around 55% of the entire Japanese ETF market. The market expects buying from the BoJ to increase further in the near term. Goldman Sachs estimates buying from the BoJ to increase to around $90 billion from the current $27 billion. That would make the BoJ one of the largest players in the equity markets. The infusion of liquidity in the market provides a much-needed boost to investor confidence, though it also props up valuations.