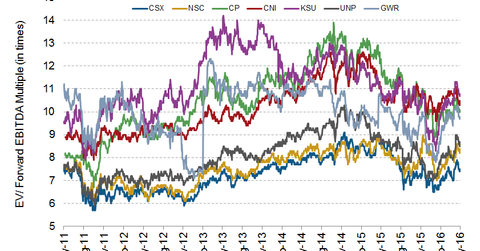

How Does the Market Value Major US Railroads?

The EV-to-forward EBITDA ratio denotes how a railroad is valued for each dollar of EBITDA that it’s anticipated to earn.

May 13 2016, Published 1:18 p.m. ET

Major US railroads’ valuation

Railroad stocks are cyclical in nature. They move along with the swings in the economy. Rail carriers are capital intensive. They have high levels of depreciation and amortization. In addition, the companies have varying degrees of financial leverage. It’s better to value and compare the railroads using EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) multiples.

Understanding the EV-to-forward EBITDA multiple

The EV-to-forward EBITDA ratio denotes how a railroad is valued for each dollar of EBITDA that it’s anticipated to earn. A lower multiple might suggest an undervalued railroad, but not always. Railroads with higher risk may also have low valuation multiples. The risk can be in any form such as financial risk, including higher leverage, or operational risk. Railroads with a “No-Darling” status among investors might also be trading at lower valuation multiples.

Kansas City Southern’s highest multiple

Kansas City Southern (KSU) was trading at a one-year forward EV-to-EBITDA multiple of 10.7x on May 11, 2016. This multiple is the highest among its peers. Investors are most likely giving a premium multiple to the railroad due to its robust intermodal business pipeline and deep network through the industrial heartlands of Mexico. Also, being the smallest Class I railroad puts some acquisition premium on the stock.

CSX’s lowest multiple

Currently, CSX (CSX) is trading at an EV-to-forward EBITDA multiple of 7.4x—the lowest among its peers. The company has an EBITDA margin of 38%. This is lowest compared to its peers’ margins. CSX’s operating margins are also on the lowest side in the peer group. In addition, the company’s exposure to coal is the highest in the peer group—taking into account the fall in 1Q16 coal revenues.

Canadian National Railway (CNI) has the second highest EV-to-forward EBITDA multiple in the peer group at 10.4x. The company has the highest EBITDA, operating profit, and net income margins in the peer group. This is due to its strong operational focus and productivity measures to align resources with demand.

The WisdomTree Earnings 500 Fund (EPS) is a growth ETF. The prominent transportation and logistics companies included in this ETF are Union Pacific, United Parcel Service (UPS), and Delta Air Lines (DAL).