Why Deutsche Bank Scrapped Dividends in 2016

Germany-based Deutsche Bank (DB) announced plans to cut dividend payments for 2015 and 2016 as part of its plans to strengthen the bank’s capital.

Feb. 8 2017, Updated 7:36 a.m. ET

Deutsche Bank didn’t pay dividends for two years

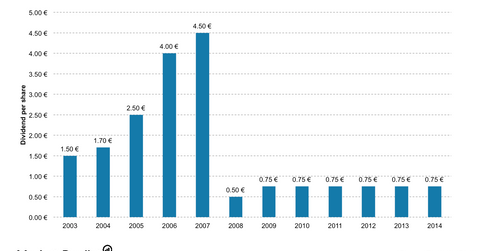

Germany-based Deutsche Bank (DB) announced plans to cut dividend payments for 2015 and 2016 as part of its plans to strengthen the bank’s capital. The bank (XLF) also mentioned that it would pay dividends from 2017 onwards at a “competitive payout ratio.” Ever since its establishment in 1952, Deutsche Bank has regularly been paying dividends. Since 2009, Deutsche Bank has been consistently paying annual dividends of 0.75 euros per share.

Rationale for the dividend cut

Deutsche Bank outlined company-wide financial targets aimed at cost cutting, reduction of debt, and lowering the amount of assets exposed to potential losses. Deutsche’s cost-to-income ratio has soared to 180%. This is partly due to the exceptional loss, but costs are generally high compared to competitors, even in divisions not affected by the loss.

CEO of Deutsche Bank, John Cryan, has been under tremendous pressure to cut down on expenses, strengthen capital, and drive value for shareholders. European banks (EUFN) like UBS, Credit Suisse (CS), and Royal Bank of Scotland (RBS) have been grappling with high costs and tougher regulatory requirements in the wake of the sovereign debt crisis.