A Look at Regeneron Pharmaceuticals’ Product Pipeline

Regeneron Pharmaceuticals (REGN) currently has 15 products in clinical development.

Feb. 22 2018, Updated 1:38 p.m. ET

Products under development

Regeneron Pharmaceuticals (REGN) currently has 15 products in clinical development. It has used its Velocimmune technology to generate all these candidates.

Products in Phase 1

Products currently under development in Phase 1 trials include REGN2810, which targets solid tumors and advanced hematologic malignancies; REGN3767, which targets advanced malignancies; REGN1979, which targets B-cell malignancies as a monotherapy and in combination with cemiplimab; and REGN 3470, which targets the Ebola virus infection.

Other products currently in Phase 1 trials are REGN3500 as a monotherapy and in combination with dupilumab for the treatment of asthma, and REGN1033 for the treatment of muscle wasting diseases.

Products in Phase 2

Regeneron Pharmaceuticals’ products currently in Phase 2 trials include dupilumab for the treatment of EOE (eosinophilic esophagitis), sarilumab for the treatment of polyarticlular course juvenile idiopathic arthritis, cemiplimab for the treatment of metastatic CSCC (cutaneous squamous cell carcinoma), and evinacumab for the treatment of refractory hypercholesterolemia.

Products in Phase 3

Regeneron Pharmaceuticals’ products in Phase 3 trials include Eylea for the treatment of NPDR (non-

The FDA (U.S. Food & Drug Administration) granted breakthrough therapy designation for dupilumab in 2016 for the treatment of atopic dermatitis in patients who are intolerant to topical medication.

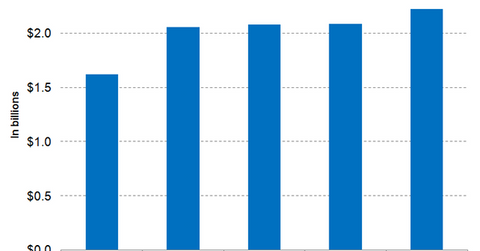

Research and development expenses

Regeneron Pharmaceuticals is expected to incur R&D (research and development) expenses of $6.3 billion for fiscal 2018. Its peers Alimera Sciences (ALIM), Momenta Pharmaceuticals (MNTA), and Pfizer (PFE) are expected to incur R&D expenses of $10.3 million, $148 million, and $7.7 billion, respectively.

In the next part of this series, we’ll take a look at the financial performance of Regeneron Pharmaceuticals.