A Closer Look at GM’s US Sales by Brand in February 2018

In 2017, General Motors’ (GM) Chevrolet brand’s retail sales fell 1.0% YoY (year-over-year). Chevrolet’s total US sales also fell 1.5% YoY in the year.

March 12 2018, Updated 10:31 a.m. ET

GM’s February 2018 retail sales

In 2017, General Motors’ (GM) Chevrolet brand’s retail sales fell 1.0% YoY (year-over-year). Chevrolet’s total US sales also fell 1.5% YoY in the year.

However, after a 5% YoY rise in January 2018, Chevrolet’s total US sales fell sharply in February, negative affecting GM’s total US sales. Let’s take a closer look.

Brand-wise sales in February

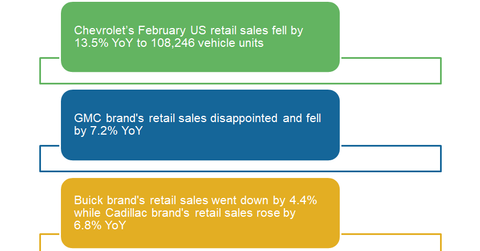

In February 2018, the US retail vehicle sales (IYK) performances of GM’s four key brands were as follows:

- The retail sales of the company’s key brand, Chevrolet, fell 13.5% YoY to 108,000 vehicle units in February. Nevertheless, this number was higher than Chevrolet’s January retail sales of 102,000 units due to seasonality. The brand’s total sales fell 8.8% YoY last month.

- Total US sales of GMC brand vehicles were 43,000 units, a 0% YoY fall. The GMC brand’s retail sales fell 7.2% YoY to 36,000 units.

- About 16,000 units of Buick brand vehicles were sold in February, a rise of 1.2%. Of these, 15,000 units were sold to US retail customers, which reflected a fall of 4.4% YoY.

- In February 2018, US sales of Cadillac brand vehicles witnessed a fall of 14% YoY. Similarly, its retail segment sales rose 6.8% to 10,000 units.

Why do Chevrolet sales matter?

Since the early years of General Motors, its Chevrolet brand has been the largest contributor to its total sales volumes. After the strength it saw in January, Chevrolet’s sales fell again in February, reflecting a pessimism that could hurt GM’s 1Q18 earnings.

Note that Chevrolet plays a key role in giving GM an edge over its peers, including Ford Motor Company (F), Fiat Chrysler Automobiles (FCAU), and Toyota Motor (TM), in its home market. Ford, Toyota, and FCAU were the second-, third-, and fourth-largest auto companies in the US market after GM by 2017 sales volume.

Read on to the next article to know what Wall Street analysts are recommending for the top two US automakers, GM and Ford.