Chicken, Beef, or Pork: Which Segment Drove Tyson Foods’ Revenue?

In Tyson Foods’ Chicken segment, sales improved in 2Q16. The segment reported $2,737 million in net sales.

May 12 2016, Published 9:24 a.m. ET

Segmental performance in fiscal 2Q16

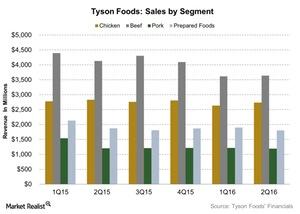

Tyson Foods (TSN) operates through four main segments: Chicken, Beef, Pork, and Prepared Foods. The Beef and Chicken segments contributed the most to total net sales in fiscal 2Q16, and the Chicken segment contributed the most to total operating profit.

Chicken, Beef, and Pork segments

In the Chicken segment, sales improved in 2Q16. The segment reported $2,737 million in net sales. The average sales price also fell as feed ingredient costs dropped. This was partially offset by mix changes. The operating profit for this segment increased to $347 million due to better operational execution and lower feed ingredient costs. Feed costs fell $80 million in fiscal 2Q16.

In the Beef segment, the livestock costs fell because of higher domestic availability of fed cattle supplies. This resulted in a drop in average sales price. The segment reported net sales of $3,639 million in fiscal 2Q16. An increase in live cattle processed as a result of higher fed cattle supplies drove the increase in sales volume. Favorable market conditions related to an increase in cattle supply, which drove down fed cattle costs, resulted in the rise in operating profit to $46 million.

In the Pork segment, better demand for pork products resulted in a sales volume increase in 2Q16. Sales volume rose 3.1% in fiscal 2Q16 as a result of improved demand for pork products. This result excludes the divestiture effect. Net sales came in at $1,190 million. The average sales price fell because of lower livestock costs and an increase in live hog supplies. Better plant utilization, accompanied by higher volumes, led to a better operating profit of $140 million.

Prepared Foods segment

The sales volume of the Prepared Foods segment was flat in fiscal 2Q16. A drop in input prices reduced the average sales price. However, this was partially offset by a change in product mix. Lower input costs of ~$220 million and mix changes of $95 million helped to improve operating income. This segment also benefited from $111 million in synergies. The amount that was realized in fiscal 2Q16 was $41 million.

The company’s peers in the industry include Campbell Soup Company (CPB), ConAgra Foods (CAG), and Mead Johnson Nutrition Company (MJN). They reported operating margins of 18.8%, 10.6%, and 15.6%, respectively, for their last quarters. The Guggenheim S&P 500 Equal Weight Consumer Staples ETF (RHS) and the iShares Morningstar Mid-Cap Value ETF (JKI) invest 2.6% and 1.3%, respectively, of their portfolios in Tyson Foods’ stock, as of May 11.

In the next article in this series, we’ll look at Tyson Foods’ strategies for future growth.