A Brief Look at Boston Scientific’s Business Model

Boston Scientific’s (BSX) Cardiovascular segment consists of minimally invasive technologies to treat patients with a wide range of heart and vascular diseases. It is BSX’s largest business segment and generated ~39% of the company’s total revenues in 2015.

May 13 2016, Published 2:03 a.m. ET

An overview of Boston Scientific’s business

Boston Scientific offers a broad portfolio of less-invasive technologies with applications in various areas of medical specialties. It manufactures an extensive range of around 13,000 products with a focus on providing improved outcomes at low costs and increased efficiencies.

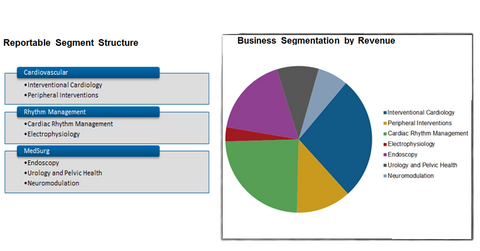

As shown in the chart below, the company reports its results under three major segments that comprise seven core areas of operations.

Cardiovascular segment

Boston Scientific’s (BSX) Cardiovascular segment consists of minimally invasive technologies to treat patients with a wide range of heart and vascular diseases. It is Boston Scientific’s largest business segment and generated ~39% of the company’s total revenues in 2015.

Some of the leading products in this segment include:

- Taxus stent

- Synergy stent

- iLab ultrasound imaging system

- LOTUS valve

MedSurg segment

MedSurg is Boston Scientific’s second-largest segment and contributes ~33% of the total revenues generated by the company in 2015. MedSurg segment further comprises of following divisions:

- Endoscopy: instruments for diagnosis and treatment of various gastrointestinal and pulmonary conditions

- Urology and Pelvic Health: devices for the treatment of urological and pelvic conditions

- Neuromodulation: devices for chronic pain management

Rhythm Management segment

Rhythm Management devices are used to monitor and treat rate and rhythm disorders of the heart. The products offered include implantable cardioverter defibrillators (or ICDs), implantable pacemakers, ablation catheters, diagnostic catheters, and delivery sheaths. This segment accounted for around 27% of the company’s total revenues in 2015.

Boston Scientific’s major competitors include Medtronic (MDT), St. Jude Medical (STJ), and Abbott Laboratories (ABT). The iShares Russell Mid-Cap Value ETF (IWS) tracks a mid-cap US companies index that aims to invest in potentially undervalued stocks as compared to their peers. Investors seeking exposure to Boston Scientific can invest in IWS, which has an exposure of around 0.9% to BSX.