The Brass Tacks of the Ingersoll Rand-Hussmann Deal

Ingersoll Rand has agreed to sell its remaining equity interest of 40% in Hussmann to Panasonic. Panasonic will buy 100% shares according to the agreement.

May 8 2016, Updated 10:06 a.m. ET

Panasonic’s role in Hussmann

Ingersoll Rand (IR) has agreed to sell its remaining equity interest of 40% in Hussmann Parent to Panasonic. Panasonic will buy 100% shares according to the agreement, and this will likely help Panasonic to concentrate and strengthen its housing operations.

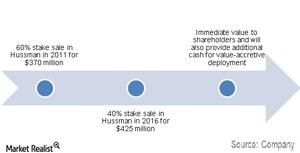

IR expects to receive net proceeds of ~$425 million from selling its 40% minority stake. The transaction is expected to close in 1H16 and is subject to customary and other approvals.

IR acquired Hussmann in 2000 for $1.5 billion in cash and approximately $275 million in debt. In September 2011, IR sold the majority of its stake (60%) to the private equity firm Clayton, Dubilier & Rice for $370 million.

Hussmann’s sale and Ingersoll Rand

According to IR’s management, selling its remaining minority stake in Hussmann will benefit shareholders in the short term. The company will deploy the remaining additional cash in value-accretive opportunities in 2016. The cash deployed is expected to benefit IR in the long term.

About Hussmann

Hussmann is a pioneer in providing innovative products and services to the retail food industry as well as refrigeration systems for customers. It manufactures, sells, installs, and services display equipment that help food retailers become more efficient and effective.

Hussmann serves several key markets, including supermarkets, mass merchants, convenience stores, drug stores, dollar and discount stores, and foodservice operations.

Notably, IR is a part of the Guggenheim Mid-Cap Core ETF (CZA) and accounts for 2.0% of the fund’s total holdings. IR is also part of the S&P 500 (SPY) and has been for more than five years. Some of the players in the HVAC space will be Honeywell (HON), ABB Limited (ABB), Atlas Copco, and Lennox International (LII).

Continue to the next part for a look at what Wall Street analysts are expecting for Ingersoll Rand and peers in 2016.