How Did AngloGold Reduce Its Costs despite Lower Production?

AngloGold Ashanti that for the last three years, its management’s focus has been on the widening of its margins on a sustainable basis.

Dec. 4 2020, Updated 10:53 a.m. ET

Focus on margin expansion

AngloGold Ashanti (AU) mentioned during its 1Q16 earnings conference call that for the last three years, its management’s focus has been on the widening of its margins on a sustainable basis.

1Q16 has shown great improvement in this regard, with its margin on all-in sustaining costs (or AISC) coming in at its highest level in more than three years.

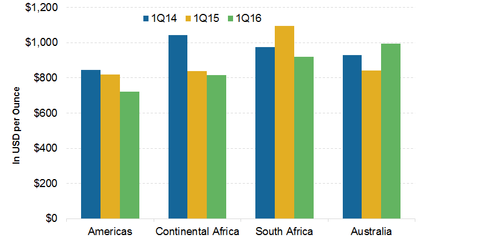

Note that despite gold prices’ falling 3% year-over-year (or YoY) in 1Q16 and production’s falling 7.2% YoY, AngloGold’s total cash costs fell 5%, and its AISC fell by 7% YoY. Its AISC for the quarter came in at $860 per ounce.

South African costs improve

AU’s AISC in the South African region fell 16% YoY due to the weaker South African rand and lower capital expenditure. This was despite lower production and higher input costs, including power and labor.

AU’s South African peers such as Harmony Gold (HMY), Sibanye Gold (SBGL), and Gold Fields (GFI) have also been reaping the benefits of the weaker rand since December 2015. Sibanye Gold makes up 2.1% of the VanEck Vectors Gold Miners ETF (GDX).

Costs for international operations

Among AU’s international operations, its AISC rose by 12% YoY in the Americas due to strong cash management, savings initiatives, and weaker local currencies. Costs at its Australia division were negatively impacted by its Tropicana mine, owing to decreased grades and the mining deferrals at some pits.

The company maintained its 2016 cost guidance of between $680 and $720 per ounce for cash costs and AISC of between $900 and $960 per ounce.

Most of the currencies AngloGold operates in, including the rand, the Argentine peso, the Australian dollar, and the Brazilian real, have weakened significantly since the start of 2016. Any strength in the US dollar compared to these producer currencies could mean more upside to AU’s costs going forward.

Now, let’s focus on AngloGold’s free cash flow generation and debt reduction efforts.