The Word on the Street: What Analysts Are Saying about Wendy’s

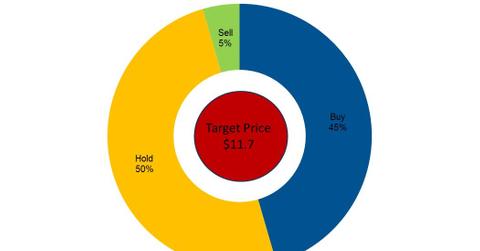

According to Bloomberg, of the ten analysts surveyed, 45.5% have issued “buy” recommendations for Wendy’s, while 50% have issued “hold” recommendations.

July 8 2016, Updated 9:05 a.m. ET

Analyst recommendations

As of June 29, 2016, Wendy’s (WEN) shares were trading at $9.5. Wendy’s share price may have already priced in the estimates that we discussed earlier in this series.

On the high side, Michael W. Gallo of C.L. King & Associates has forecast Wendy’s share price to touch $14.5 in the next 12 month, which would represent a return of 53.1%. On the low side, Keith Siegner of UBS Investment Bank has predicted that Wendy’s share price will reach $9, which would be a decline of 5%.

The 12-month price targets for Wendy’s peers are as follows:

Analyst recommendations

According to a Bloomberg consensus, of the ten analysts surveyed, 45.5% have issued “buy” recommendations for Wendy’s, while 50% have issued “hold” recommendations, and 4.5% have issued “sell” recommendations.

Remember, Wendy’s share prices generally move in tandem with analyst recommendations. As analysts raise their consensus target price, the price of the stock may also increase, and vice versa. But a share price that is lower than its target price doesn’t indicate an automatic “buy.” Before investing, investors should carefully analyze the various metrics we’ve discussed in this series.

Wendy’s makes up 0.31% of the iShares S&P Mid-Cap 400 Growth ETF (IJK).