United Parcel Service: Key Growth Focus Areas

Recently, United Parcel Service has broadened the service offering of UPS My Choice to 15 more countries and territories in the Americas and Europe.

April 11 2016, Updated 2:07 p.m. ET

UPS’s business strategy

Today, United Parcel Service (UPS) boasts a broad range of logistics capabilities. The company has a balanced presence in North America, Europe, the Middle East, Africa, Asia-Pacific, and Latin America.

It has adapted cutting-edge technologies for creating competitive advantage in nearly all the markets served. UPS has invested a substantial amount in creating user-friendly technologies and visibility tools for its customers.

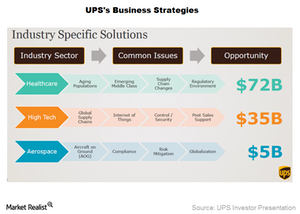

UPS offers customized value propositions to an array of sectors including industrial manufacturing, retail, professional and consumer services, aerospace, automotive, healthcare, and high tech. The company renders global sourcing and repair space to customers to leverage the largest global networks of post-sales facilities.

Expansion of global trade

United Parcel Service (UPS) has invested heavily in enhancing its European ground network to provide seamless service to its customers. Plus, it has been keeping an eye on the developments in the emerging markets. UPS expects that a majority of the global GDP growth will come from this market over the next ten years.

In the last ten years, the company has established a strong market presence in three leading emerging markets: China, Poland, and Turkey. In addition, it has focused on the Middle East, Latin America, Africa, and Eastern Europe as important growth destinations.

The 2015 Trans-Pacific Partnership agreement is expected to connect 12 global economies and 800 million consumers across the Americas and the Asia-Pacific regions. Cross-border trade along with transcontinental trade is believed to grow faster than the US production in the coming times. This could help UPS to explore newer territories and business opportunities.

Growth of e-commerce

UPS’s integrated network gives it the competitive advantage to cash in on the shift toward residential deliveries. The company’s offerings support retailers across their value chains from global sourcing to distribution and returns. It provides low-cost solutions such as UPS SurePost for US domestic shipments and UPS i-parcel for a cost-effective deferred cross-border solution.

Leveraging e-commerce, UPS offers UPS My Choice, which is a service that enables receivers to have control of their inbound shipments. This system helps 22 million customers to keep an eye on their parcel delivery status through a system of alerts. It also offers a flexible delivery option to decide the delivery dates of these parcels.

Recently, United Parcel Service has broadened the service offering of UPS My Choice to 15 more countries and territories in the Americas and Europe. UPS My Choice contains an added feature in which the customers can divert parcels to UPS Access Point locations. These locations include anything from a UPS Store to other local businesses for easy pickup and drop-off of packages.

Investing in ETFs

UPS forms 3.9% of the Industrial Select Sector SPDR ETF (XLI). Competitors in the United States include Delta Air Lines (DAL), C.H. Robinson Worldwide (CHRW), FedEx (FDX), and XPO Logistics (XPO). Airlines and railroads make up 12.6% and 7.3%, respectively, of the portfolio holdings of XLI.

In the next article, we’ll see how UPS managed to climb the ranks in the courier industry through technological innovations.