Must-know: How does AmeriGas stack up against its competition?

APU competes with Suburban Propane (SPH) and Ferrellgas Partners (FGP). APU is the country’s largest retail propane marketer, serving 2 million customers in all 50 states.

May 3 2021, Updated 10:36 a.m. ET

Amerigas versus its peers

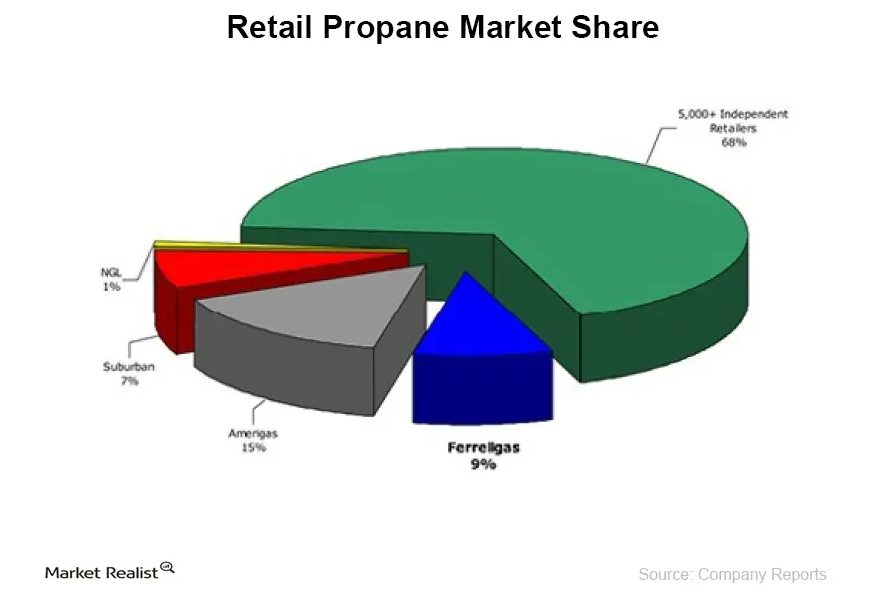

AmeriGas Partners (APU) purchases propane to sell to residential, industrial, and commercial end customers and has approximately 15% of the retail propane market, according to a company presentation by competitor Ferrellgas.

APU competes with Suburban Propane (SPH) and Ferrellgas Partners (FGP). APU is the country’s largest retail propane marketer, serving 2 million customers in all 50 states. Suburban Propane serves approximately 750,000 residential and commercial customers through 300 locations in 30 states (primarily on the East and West coasts). FGP serves approximately 1 million customers in all 50 states.

Over the past 12 months, the group has seen mixed results. Unit prices appreciated less than 10% for APU and SPH, while FGP gained 30%.

Higher demand and low U.S. propane inventories created shortages and drove wholesale prices significantly higher, making it challenging for propane distributors like AmeriGas to meet delivery commitments and maintain strong per-gallon prices. However, because of the size of APU’s transport fleet and breadth of operations across the country, AmeriGas was able to meet demand.

AmeriGas benefits from geographic diversity (APU distributes propane in all 50 states) in addition to customer density. This means that deliveries are usually in neighborhoods with many AmeriGas customers, translating to operational efficiency. APU also benefits from end-use diversity (residential, commercial, industrial, and agricultural).

APU is a major name in the U.S. propane distribution industry. Other propane companies operating in this space include Ferrellgas Partners (FGP), Suburban Propane (SPH), and NGL Energy Partners (NGL). AmeriGas is part of the Yorkville High Income MLP ETF (YMLP), an ETF that tracks select MLPs.