Multinational and Japanese Pharmaceuticals Should Build Alliances

The Japanese pharmaceuticals market is not very welcoming to foreign companies. Similarly, the Japanese population is quite loyal to domestic manufacturers.

Nov. 20 2020, Updated 1:15 p.m. ET

Entry of US companies in Japanese pharmaceutical market

The Japanese pharmaceuticals market is not very welcoming to foreign companies. Similarly, the Japanese population is quite loyal to domestic manufacturers. This makes for a difficult environment for multinational pharmaceutical companies that want to enter the Japanese market.

The multinational companies can’t ignore the Japanese pharmaceuticals industry, as it’s the world’s second-largest individual market in terms of value. To overcome this hurdle, these companies are forming strategic alliances with domestic players. Though such alliances have failed in the past following disappointment over profit sharing, the companies are entering into long-term development and commercialization deals with domestic companies.

Amgen (AMGN) had sold its Japanese unit to Takeda Pharmaceutical (TKPYY) in 2008, as the company found it expensive to launch and commercialize products in the country.

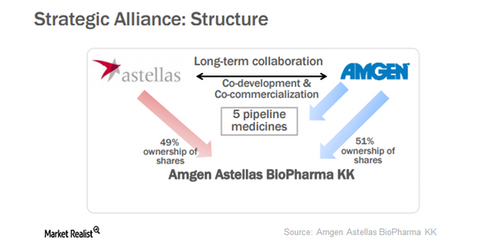

In May 2013, Amgen formed a strategic alliance with Astellas Pharma NPV (ALPMF). Through this alliance, both the companies together developed and commercialized five pipeline molecules including four biologics for the Japanese market. Astellas’s strong reputation in the Japanese market enabled Amgen to develop and commercialize its products in Japan.

What is an orphan drug in Japan?

A drug that targets a population of fewer than 50,000 patients along with its excellent usefulness qualifies a drug for “orphan drug” status in Japan. These drugs are entitled to certain benefits such as “financial aid, tax relief on research expenses, guidance and advice, priority review, and extension of the reexamination period from the conventional 8 years to a maximum of 10 years for drugs and from 4 years to a maximum of 7 years for medical devices.”

Another strategy to enter Japan

In order to enter the Japanese pharmaceuticals market, companies are adopting a familiar strategy known as reverse co-promotion. In reverse co-promotion, the foreign company delivers the product to a domestic partner at an agreed-upon price, which is the transfer price. The domestic partner, being the sole distributor of the product, targets higher sales. So in this mutual relationship, the foreign company enjoys wider margins, whereas the domestic partner books higher sales.

Certain indexes that offer exclusive exposure to Japanese equities. The iShares MSCI Japan ETF (EWJ) is one such option that invests ~8.7% in healthcare stocks. Certain funds such as the Vanguard FTSE All-World Ex-US Index Fund (VEU) offer exposure to European equities along with Japanese stocks. VEU invests 0.6% and 0.55% in Sanofi (SNY) and Novo Nordisk (NVO), respectively.