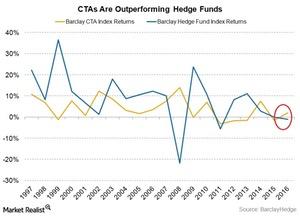

Why Commodity Trading Advisors Are Outperforming Hedge Funds

The Barclay CTA Index, which serves as a benchmark of the representative performance of CTAs (commodity trading advisors), has risen 2.0%, as of March 31.

April 13 2016, Updated 11:54 a.m. ET

CTAs are outperforming hedge funds

In 2016, CTAs (commodity trading advisors) have largely outperformed hedge funds. The Barclay Hedge Fund Index, a measure of the average return of all reporting hedge funds, has fallen about 1% year-to-date, as of March 31, 2016. The Barclay CTA Index, which represents the performance of CTAs, has risen 2.0% over the same period. In this series, we’ll look into the reasons behind this strong performance, along with strategies that have worked for CTAs.

When do CTAs work better?

Hedge funds are effective in protecting against losses when returns start sliding. However, when the markets are highly volatile or down, hedge funds start to lose, as well, as their investments are not totally liquid. CTAs, on the other hand, are quick to act when the markets (SPY) (IWM) fall. They deal in alternative investments such as futures contracts, which let them short immediately, thereby protecting investor returns.

Why have CTAs outperformed hedge funds?

When equities fall, investors often look at commodities for returns and diversification. However, investing in commodities is a costly affair. Plus, there’s the added disadvantage of illiquidity. CTAs provide a solution to both these issues. By trading derivative contracts (futures) on these commodities, they provide diversification along with liquidity to investors. This is precisely why CTAs have been able to outperform hedge funds in 2016. Equities have seen a pretty bad year so far. Commodity prices have shown some reversal, but have had their upswings and downswings, which are easily managed by CTAs, who can enter and exit contracts based on the Market’s direction.

How to gain access?

Programs managed by CTAs often require high minimum investments. This is where “smart beta” funds (AQMIX) (LOTAX) (EBSAX), which reflect CTA programs’ active investment style in a more accessible way, come into the picture. In this series, we’ll shed light on funds that investors can use to gain the same kind of exposure that CTA programs offer.

At the close of 2015, the markets saw macro and CTA hedge fund strategies gain popularity. The trend-following Systematic Diversified CTA fund was a clear winner. We’ll discuss these strategies and the performance of such funds as we move ahead in this series.