How Coca-Cola’s Margins Fared in 2018

Higher freight costs and adverse currency fluctuations are expected to continue to impact Coca-Cola’s margins in 2019.

Feb. 19 2019, Updated 12:00 p.m. ET

Gross margin in 2018

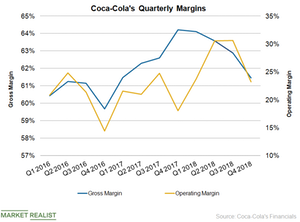

Coca-Cola’s (KO) gross margin expanded in the full-year 2018, although it declined in the fourth quarter of 2018. Coca-Cola’s gross margin declined to about 61.4% in the fourth quarter of 2018 compared to 64.2% in the fourth quarter of 2017. A challenging cost environment, the impact of accounting changes related to the adoption of a new revenue recognition standard, and currency headwinds impacted the company’s gross margin.

Coca-Cola’s gross margin improved to 63.1% in 2018 from 62.6% in 2017, reflecting the favorable impact of the refranchising of the company’s bottling operations. Coca-Cola’s bottling business is capital-intensive and carries a lower margin than its concentrates business.

Coca-Cola’s operating margin expanded 516 basis points on a year-over-year basis to 23.2% in the 2018 fourth quarter. Coca-Cola’s adjusted operating margin increased 13 basis points to 26.0% in the fourth quarter. Coca-Cola’s operating margin expanded 585 basis points to 27.3% on a reported basis in 2018 and 385 basis points on an adjusted basis to 30.8%.

The company’s operating margin was favorably impacted by productivity initiatives and the adoption of a new revenue recognition accounting standard and adverse foreign currency fluctuations.

Margin outlook

Higher freight costs and adverse currency fluctuations are expected to continue to impact Coca-Cola’s margins in 2019. The company will likely fight commodity inflation with higher pricing, efficient expense management, and the favorable impact of refranchising of bottling operations. Coca-Cola aims to deliver $600 million in productivity savings in 2019.

Coca-Cola’s productivity initiatives are focused on the restructuring of its global supply chain, implementing zero-based budgeting, streamlining the company’s operating model, and driving efficiency in direct marketing spending. The company is redirecting its productivity savings towards marketing and innovation of better beverages.

We’ll discuss Coca-Cola’s valuation in the next part of this series.