What Can Investors Expect from Kellogg’s 2Q16 Results?

Kellogg Company (K) is headquartered in Battle Creek, Michigan. It’s set to report its fiscal 2Q16 results on August 4, 2016, before the market opens.

July 27 2016, Published 11:44 a.m. ET

Revenue and EPS estimates

Kellogg Company (K) is headquartered in Battle Creek, Michigan. It’s set to report its fiscal 2Q16 results on August 4, 2016, before the market opens. Management will discuss the results over a call after the opening bell. Its earnings and revenue are expected to fall by 1% and 4%. We’ll discuss the estimates more in the next parts in this series.

Kellogg manufactures and markets ready-to-eat cereal and convenience foods. Its key brands include Kellogg’s, Keebler, Cheez-It, Murray, Austin, and Famous Amos.

How much has Kellogg gained since 1Q16?

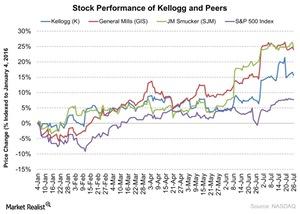

Kellogg stock has gained 10% since its 1Q16 earnings release on May 5. The stock fell 3% after the company reported its fiscal 1Q16 results. The company beat earnings estimates by 3%. Its revenue missed estimates slightly by 1.7%. So far, the stock has gained 16% in 2016. It fell as much as 10% in fiscal 2015. It outperformed the Market, represented by the S&P 500 Index, by 9% as of July 26.

Peers’ stock performance

Kellogg is part of the processed and packaged goods industry. It has a market cap of $29 billion. Kellogg’s largest customer is Walmart (WMT). So far, Walmart returned 20.3% in 2016. Its peers in the industry include General Mills (GIS) and J.M. Smucker (SJM). So far in 2016, General Mills has returned 24%, while Smucker has returned 24%. General Mills and Smucker closed trade at $71.28 and $152.72, respectively, on July 26.

The iShares KLD Select Social ETF (KLD) invests 2.1% of its portfolio in Kellogg. The PowerShares High Yield Equity Divide (PEY) invests 1.6% of its portfolio in Kellogg.

What’s in the series?

In this preview series for Kellogg, we’ll cover analysts’ revenue estimates, earnings per share, and what could impact its revenue and earnings. We’ll also do a quick recap of how the company performed in the last quarter. We’ll look at the company’s dividend paid and its updated guidance. Finally, we’ll look at Kellogg’s valuation, Wall Street analysts’ recommendations over the next 12 months, and the moving averages.

Let’s start with revenue expectations for the second quarter.