Why Procter & Gamble Is Selling Some of Its Brands

Procter & Gamble is on a mission to trim brands that are holding back its overall financial performance.

March 8 2016, Published 4:02 p.m. ET

P&G’s sale of Hipoglós diaper rash cream to JNJ

On March 2, 2016, Procter & Gamble (PG) announced the sale of its Hipoglós diaper rash cream brand in Brazil to Johnson & Johnson Consumer (JNJ). The financial terms of the deal haven’t been disclosed yet. However, the transaction is expected to close in the next four to six months subject to necessary approvals.

P&G’s sale of Escudo soap to KMB

On February 22, 2016, P&G announced the sale of its Escudo soap brand in Mexico and other Latin American countries to Kimberly-Clark’s (KMB) Mexican subsidiary, Kimberly-Clark de Mexico, for an undisclosed amount. The transaction is expected to close during the first half of 2016 subject to necessary regulatory approvals.

Why have these divestitures occurred?

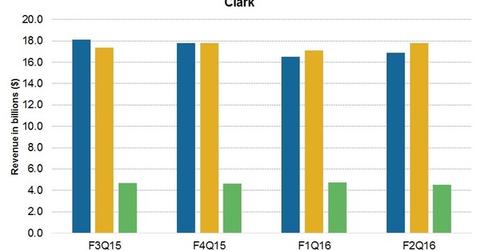

Procter & Gamble is on a mission to trim brands that are holding back its overall financial performance. During the 2Q16 earnings release, CFO Jon Moeller mentioned that in addition to transforming cost structure, P&G is focusing on transforming its portfolio.

The company plans to center its portfolio with ten category-based business units where P&G has leading market positions, strong brands, and consumer-meaningful product technologies.

The company’s strategic actions will best leverage its core competencies, which will help its global positioning and top line. In the next part of the series, we will discuss P&G’s completion of the transfer of its Duracell business to Berkshire Hathaway (BRK-B) and P&G’s stock price movement.

P&G makes up 2.0% of the PowerShares High Yield Equity Dividend Achievers Portfolio (PEY) [1. Updated on March 7, 2016].