What Will Drive Vale SA’s Iron Ore Division Going Forward?

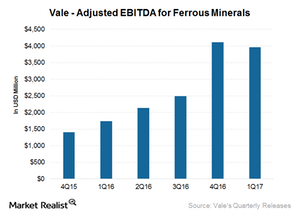

In 1Q17, Vale’s (VALE) ferrous division accounted for ~89.0% of its adjusted EBITDA (earnings before interest, tax, depreciation, and amortization).

June 16 2017, Updated 7:38 a.m. ET

Iron ore price realization

In 1Q17, Vale’s (VALE) ferrous division accounted for ~89.0% of its adjusted EBITDA (earnings before interest, tax, depreciation, and amortization). The company’s EBITDA for ferrous minerals was $4.0 billion. This was slightly lower than the EBITDA achieved in 4Q16. The seasonally lower sales volumes were the main reason behind this drop.

The company’s price realization also rose during the quarter as the CFR (cost and freight) reference price for iron ore fines rose by $7.5 per ton to $86.7 per ton in 1Q17. This rise resulted in a price realization of $85.6 per ton for Vale in 1Q17.

Cost increases

Along with realized prices, Vale’s C1 cash costs also rose by $0.3 per ton from 4Q16 to $14.7 per ton in 1Q17, mainly due to lower sales volumes as we discussed above. The appreciation of the Brazilian real against the US dollar also led to some of the price increases during the quarter.

Peers’ costs

As compared to Vale, BHP Billiton’s (BHP) WAIO (West Australian iron ore) had a unit cash cost of $15.50 per ton for the six months ended December 2016. Rio Tinto (RIO) had a unit cost of $13.7 per ton for its Pilbara operations. While Cliffs Natural Resources (CLF) isn’t directly comparable to the other three, it has also reduced its production costs in the United States due to headcount reduction and other input costs.

Rio Tinto, Vale, and BHP Billiton make up 32.1% of the iShares MSCI Global Metals & Mining Producers ETF (PICK).

Now let’s discuss whether Vale’s focus on costs will improve its profitability in coal.