Challenges for the Western Digital-SanDisk Merger

One of Western Digital’s top shareholders, Alken Asset Management, opposed the merger in its open letter to Western Digital’s board.

Nov. 20 2020, Updated 11:19 a.m. ET

Merger will generate $20 billion in revenue

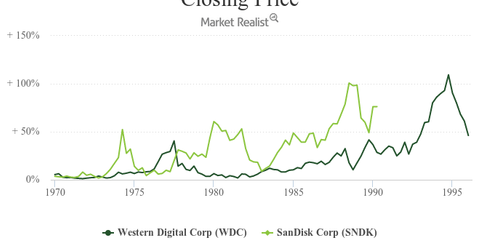

In the previous part of the series, we saw that Western Digital (WDC) and SanDisk (SNDK) shareholders approved the merger of the two entities to create a combined company with revenue of ~$20 billion. The combined company would have a comprehensive portfolio of storage products. It would become a stronger player in the storage industry. The storage industry has been going through consolidation. It reported the biggest tech merger of EMC (EMC) by Dell for $67 billion in 2015.

[marketrealist-chart id=1146611]

Merger roadblocks

The announcement of shareholder approval brought some relief to Western Digital’s stock price. The merger was in trouble a month ago.

One of Western Digital’s top shareholders, Alken Asset Management, opposed the merger in its open letter to Western Digital’s board. The letter was dated February 22, 2016. It stated that SanDisk posted declining earnings in fiscal 2015 after a strong fiscal 2014 as the SSD (solid-state drive) price fell rapidly. SanDisk also posted weak guidance for fiscal 1Q16 as the storage industry transitions from 2D to 3D flash memory technology.

Moreover, the competition is intensifying in the flash memory space. Market leaders Samsung (SSNLF) and Micron Technology (MU) are investing in flash memory capacity. The consumer market for these storage products is slowing. SSDs, HDDs (hard disk drive), and flash memory are mainly used in PCs and smartphones that are nearing stagnation.

Alken stated that the $19 billion tag was too high for an ailing company like SanDisk. Exiting the merger by paying a $184 million termination fee would be a more profitable decision.

Unisplendour withdrew from the acquisition

A day after Alken’s letter, China’s Unisplendour withdrew its offer to acquire 15% stake in Western Digital for ~$3.8 billion. The U.S. Committee on Foreign Investment stated its intentions to investigate the deal.

In the next part of the series, we’ll discuss the reason behind Unisplendour’s withdrawal and Western Digital’s reaction. The iShares Russell 1000 Value ETF (IWD) invests in large-cap stocks across multiple sectors including technology. It has 0.11% exposure in Western Digital, 0.16% in SanDisk, 0.48% in EMC, and 0.11% in Micron Technology.